The EUR/USD pair is expected to react to the release of the minutes from the most recent US Federal Reserve (Fed) meeting, as well as to the Purchasing Managers’ Index (PMI) readings for manufacturing and services from both Europe and the United States.

Overall, according to the economic calendar data, major U.S. data releases were mixed, as both consumer and producer price readings were stronger than anticipated, while retail sales data were weaker. Inflation data significantly impacted the Treasury market, causing the EUR/USD exchange rate to net gains. However, the pair also experienced slight losses, dropping to 1.0770.

From an overall perspective, market confidence in a near-term Federal Reserve interest rate cut has diminished, with the probability of a rate cut in May decreasing significantly. The International Commercial Bank had pointed to stronger-than-expected consumer price data.

The European Central Bank continues to wait for the U.S. Federal Reserve to take action if the economy shows signs of weakness. The development of core inflation stalled for the first time in six months. This advance in core inflation achieved in the second half of last year continues to make the Fed less willing to hold off on a material slowdown in the economy.

However, analysts are unclear as to how the EUR/USD will behave. Some say that there may be high expectations on the part of the dollar (USD) and this could generate a bullish view that at the same time impact the market’s risk appetite.

Other analysts claim that the potential for gains concerning the dollar is limited. Equally, one should not overlook whether there are breaks in support levels that may allow the dollar price to devalue at one point and then rebound and become much more valuable.

It should also be considered that if the economy accelerates again, the Federal Reserve may be compelled to tighten its monetary policy, potentially leading to a rise in the dollar’s value.

Meanwhile, Europe continues to grapple with persistent inflation, suggesting that monetary policies may not have been effective enough to restore investor confidence in the market. Despite this, the European Central Bank is expected to keep interest rates on hold at least until the summer in July. This is because there is a combination of growth and inflation that may hinder the recovery of the euro (EUR).

Likewise, the market foresees that a fall in the price of EUR/USD is possible in the coming days or even in the remainder of the year. Thinking short, if the price goes down, it would be ideal to sell if there are price rallies.

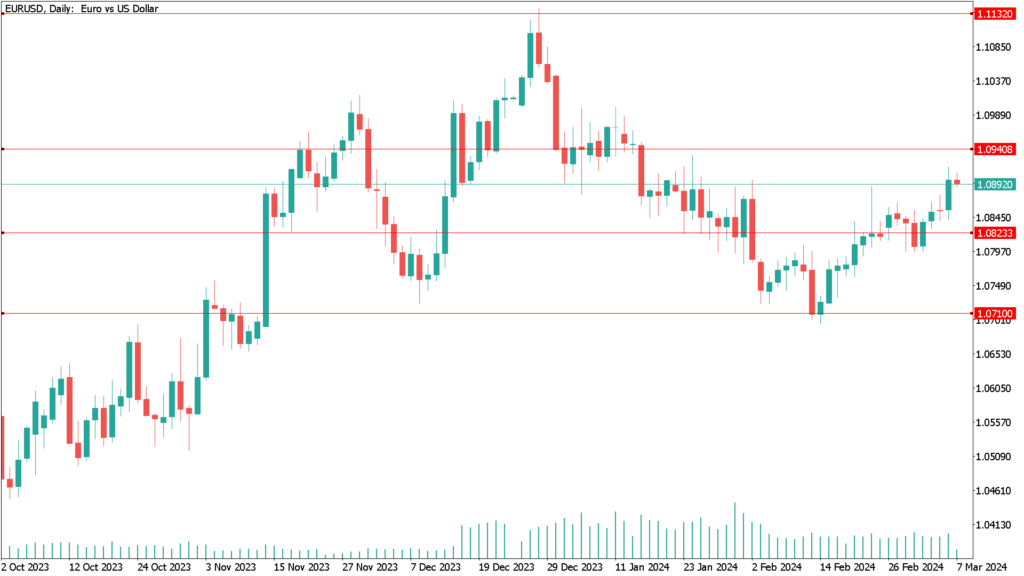

Daily Technical Analysis EUR/USD February 19th

A quiet session is expected amid the US holiday, which negatively impacts liquidity along with investors’ risk-taking. Consequently, EUR/USD may continue to move within ranges and may settle near the psychological support level located at 1.0800, as there are still external factors supporting the dollar’s strength in the market..

Currently, the nearest support levels according to the chart are 1.0720 and 1.0580 while from the second and last level, technical indicators may move into oversold territory.

In contrast, using the same time frame, a review and analysis of the overall downtrend is not generated without returning to the vicinity of the resistance level of 1.0885. As previously mentioned, the EUR/USD will move in reaction to the release of the minutes of the last meeting by the Federal Reserve along with the Purchasing Managers’ Index readings for manufacturing and services industries in both the United States and Europe.