EUR/USD faces perhaps one of the most important key weeks of the economic calendar, as meetings are scheduled for both the euro zone and the United States this week.

On the euro (EUR) side, the European Central Bank (ECB) is expected to decide whether or not to lower interest rates. The PMI data to be released on Thursday will have a definitive impact on the European currency, either positively or negatively, so it is recommended to manage risk appropriately depending on the positions to be taken. Currently, the bank is debating how deep and fast interest rate cuts should be to avoid affecting an economy that is possibly weakening, as one of its major powers, Germany, has not performed as expected this year.

On the US dollar (USD) side, after the release of inflation data last week, which showed higher than expected inflation rates, the Federal Reserve (Fed) meets on Wednesday, March 20 to make decisions about monetary policy in the United States and see what measures to implement to finally bring inflation to the target levels of 2%. Likewise, market estimates suggest that there will very likely be a rate cut in the US in June.Most markets are believed to be estimating a high probability of a monetary policy change in the indicated month. It is also important to remember that the Federal Reserve will release the Summary of Economic Projections.

Given this scenario, investors may not open large positions before the Fed events, which could make it difficult for the EUR/USD pair to move in any direction. However, this sense of risk or volatility could drive both the selling and buying of EUR/USD in the short term.

Again, it is important to maintain excellent risk management as the prices of these currencies could face volatility, which could generate a lot of profits but also a lot of losses.

The economic agenda for this week will set the tone for the behavior of the most important currencies in the market.

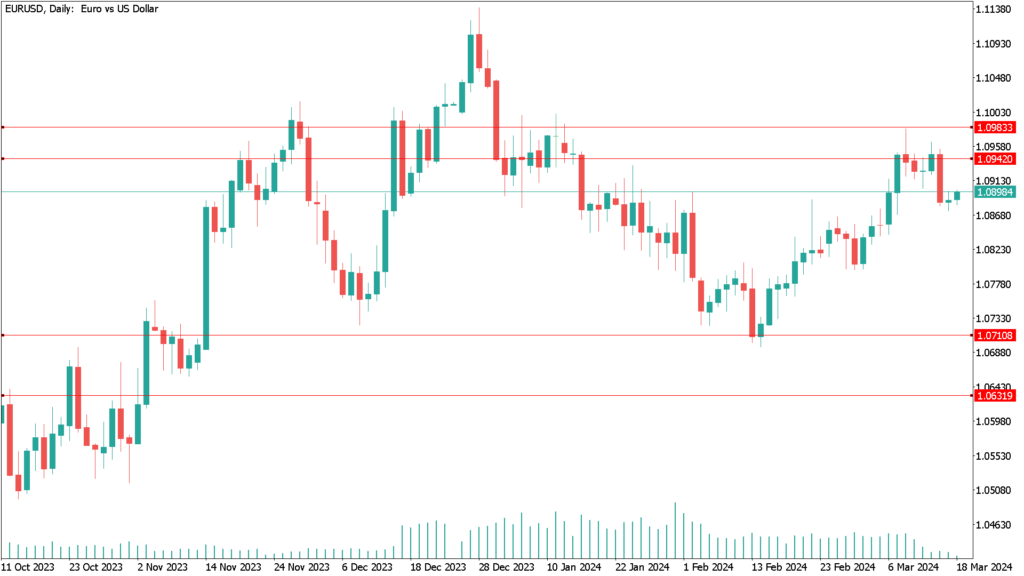

Daily technical analysis EUR/USD March 18th

The EUR/USD pair was in a continuous recovery after reaching its lowest point of the year at 1.0693, reaching a high of 1.0980 on March 8. However, the price rebounded, maintaining levels above the neutral zones, though the pair still appears weak, suggesting uncertainty in establishing a clear trend

If this weakness persists, the pair could fall below its 50 and 200 simple moving averages (SMAs) to test the support levels of 1.0796 and, in the event of a downward trend, could reach levels close to 1.0722 and 1.0693.

If the EUR/USD pair starts to rise again, the resistance could be at 1.0963. If this resistance is broken, the next resistance levels could be at 1.1016 and 1.1094.