The EUR/USD extended its gains to 1.0812 resistance after weaker than expected U.S. jobs data and settled around 1.0760 at the start of trading this week.

According to markets and analysts, there are signs that both the Fed and the ECB are going to take different paths this year. The Fed indicated in its statement last week that the economy remains solid thanks to strong consumer spending. It also did not mention when it would begin cutting rates. As a result, analysts have differing opinions. Some think they will begin later this year, while others believe September would be the ideal month, for now, inflation remains high.

According to the economic calendar information, the Consumer Price Index (CPI) increased to 3.5% during March, while the Personal Consumption Expenditure (PCE) increased to 2.5%. These numbers mean that inflation has been slow to come down and may be slow to reach the Fed’s 2% target. That said, some analysts think that this stance by the Fed may be misguided as the economy is showing signs of tightening.

On the other hand, the European Central Bank made a commitment to begin cutting interest rates in June. The inflation rate in Europe fell to around 2.4%, and lower energy costs could potentially bring it back to 2%.

Similarly, as manufacturing activity in Europe contracts, many consumers are feeling the consequences. Therefore, in the short term, there is a possibility that the dollar could strengthen against the euro.

Last week’s Non-Farm Payrolls report, released on Friday, showed the markets staying within the FOMC’s expected range, with the dollar trading at its lowest level since April 11. Forecasts for some readings were cautious, estimating that average hourly earnings remained unchanged and the headline job growth was +238,000. However, the readings were noticeably weaker and missed market estimates.

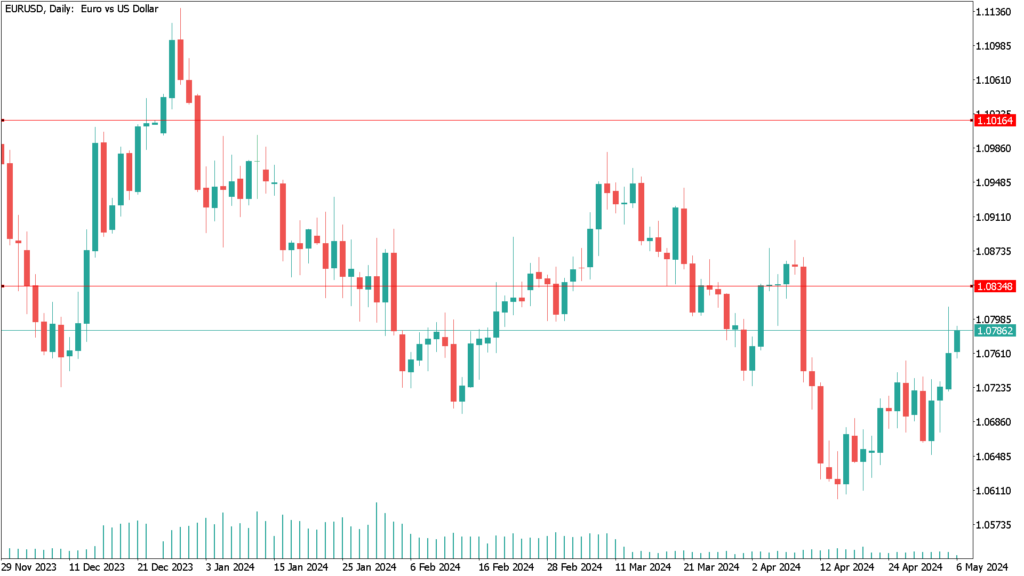

Daily technical Analysis EUR/USD May 6th:

The EUR/USD price has been stable this past period, with a possible upward bias generated by the Fed’s monetary policy. It remained stable above the key support level of 1.0700. Additionally, the EUR/USD pair has hovered just above the 1.0697 support level, marking its low since February 14. As a result, estimates for the pair are bearish. Unless the bulls make strong advances towards the resistance levels of 1.0830 and 1.100 in that order, these remain the most important areas on the daily chart.

In addition, the EUR/USD pair moved below the 50-day moving average. From a technical point of view, the pair slightly exceeded the key support level of 1.0697, its lowest point since February 14. Therefore, the outlook for the pair is bearish. Unless the bulls manage to make a strong advance towards the resistance levels of 1.0830 and 1.1000, respectively, these will remain the most prominent areas on the daily chart to confirm a trend reversal.