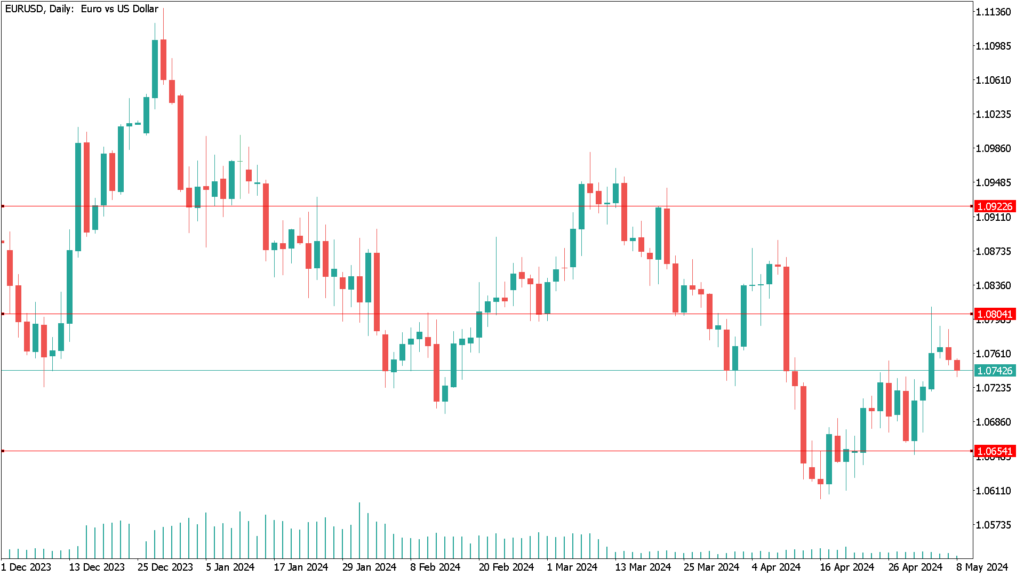

The EUR/USD has been trading in a range between 1.0790 and 1.0738 this week.

Amidst the current currency market backdrop, the EUR/USD may take cues from Thursday’s U.S. initial jobless claims report along with the preliminary University of Michigan index of U.S. consumer sentiment on Friday.

Signs of weakness in the labor market could translate into a decline for the USD, especially after the latest Non-Farm Payrolls report missed expectations.

On the other hand, another positive development in the weekly jobless claims report could support gains for the USD today. It should be noted that markets in Europe are closed for Labor Day, so there will be less liquidity than usual. According to the economic calendar data, the University of Michigan’s consumer confidence index is expected to show another decline as Americans will likely continue to face the pressures of higher costs and higher interest rates. However, an improvement in consumer confidence could lead to increased spending activity in the future, which could further boost the dollar.

The EUR/USD found support around 1.0650 this week and rose to 1.0770 after the data failed to impress. The Fed kept interest rates unchanged at 5.50% after its last meeting. Similarly, Chairman Jerome Powell stated that more evidence is needed to be confident that inflation is on a sustained downward path towards the target. This has not been achieved recently, so interest rate cuts may be delayed. Powell, however, considers another hike unnecessary.

Regarding economic data, U.S. non-farm payrolls increased by 175,000 in April compared to consensus estimates of around 240,000, while there was a small upward revision to March’s data to 315,000 from 303,000 previously reported. Additionally, the unemployment rate increased to 3.9% from 3.8%. Likewise, average hourly earnings rose 0.2% month-over-month, just below expectations of 0.3%, while annual growth slowed to 3.9% from 4.1%.

Based on the latest information, financial markets estimate two rate cuts for this year, compared to only one previously expected, with nearly a 40% chance of a rate cut in July. The recent ISM business confidence surveys for the manufacturing and services sectors pointed to a contraction in April, below consensus estimates, raising further doubts.

Overall, financial markets continue to weigh confidence that the European Central Bank will cut interest rates in June, although hopes for a recovery have tempered expectations for more drastic action in the second half of 2024.

Daily technical Analysis EUR/USD May 8th:

The EUR/USD exchange rate has likely topped out at the short-term downtrend line around 1.0800, which could lead to renewed short positions. Technical indicators are showing downward pressure, which could result in a pullback in the EUR/USD price around 1.0605. Currently, the 100-day simple moving average (SMA) is below the 200-day SMA, suggesting that the downtrend is gaining strength rather than reversing. However, the gap between the indicators is narrowing, which could indicate a slowdown in selling pressure.

A break above the trend line and the zone of interest could be enough to confirm that a bullish reversal is underway. Consequently, the EUR/USD could rise to higher levels near 1.0900 and above. Simultaneously, the stochastic oscillator is moving downward, suggesting that the price could follow this direction until it reaches the oversold zone and turns upwards. All in all, the Relative Strength Index (RSI) has more room to move lower, meaning that the EUR/USD price could encounter more selling momentum from here.