Elsewhere in Europe, Eurozone PMI data, along with specific figures from Germany and France, will be released early. These are expected to show further growth in the services sector and a slight contraction in manufacturing. Additionally, consumer confidence in Europe is expected to improve significantly, reaching its highest level since February 2022.

On the other hand, producer prices in Germany are expected to increase for the second consecutive month, albeit at a much slower pace than in April. Other relevant data to consider include the Eurozone trade balance, wage figures, and Germany’s final GDP data for the first quarter.

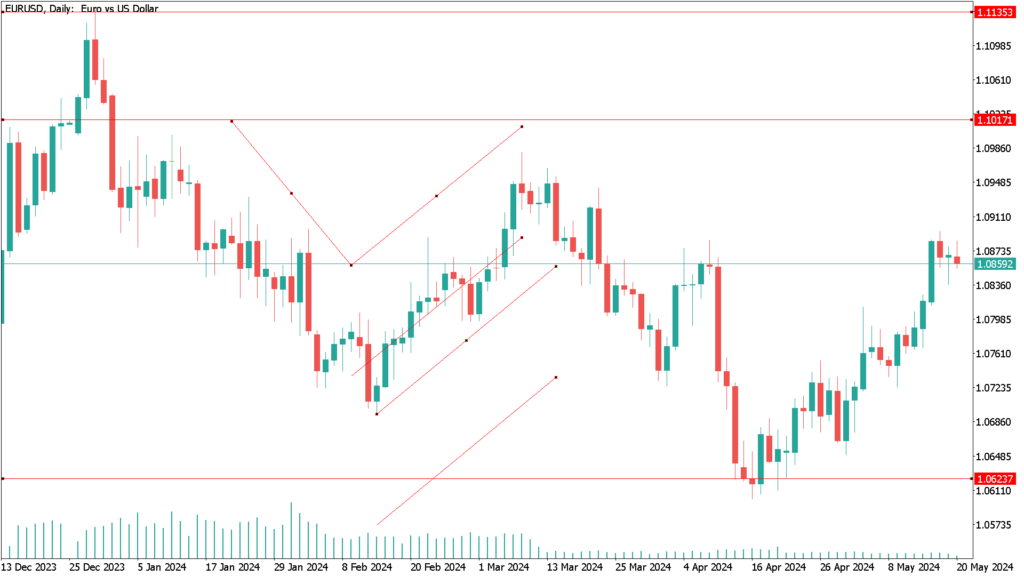

According to foreign exchange market data, the Euro (EUR) reached its highest level in a month last week. Prices were buoyed by Wednesday’s lower-than-expected US inflation report, bolstering expectations for Federal Reserve rate cuts in September and December. As a result, the Euro (EUR) has risen against the US Dollar (USD) to a high of 1.0898 on Thursday, but has since lost value to as low as 1.0843.

As for the pullback, it signifies the onset of uptrend fatigue, driven by investor caution ahead of the European Central Bank’s policy decision on June 6.

Furthermore, Cleveland Fed President Loretta Mester expressed encouragement and noted that rising long-term inflation estimates might compel the Fed to consider continuing interest rate hikes, though she clarified that this was not her baseline expectation.

Looking at the Forex charts, if the incipient Euro (EUR) reversal extends, it could reach the 200 day moving average (EMA) at 1.0788. Nonetheless, the EUR/USD technical setup looked better than the previous week.

EUR/USD daily technical analysis 20th May:

A flat trading session is expected early this week for the EUR/USD after investors and markets reacted to the latest weak US inflation figures. With a public holiday in Europe, all attention will be focused on a series of statements from Federal Reserve officials later in the week. According to the daily chart, the EUR/USD may be in a bullish channel. To confirm how strong this current trend is, bulls need to move towards the resistance levels of 10.930 and 1.1000. Otherwise, within the same time frame, a return to the support zone around 1.0769 could threaten the upside bounce.