The euro rose against all G10 currencies after euro zone inflation beat estimates. The US dollar surrendered after a personal consumption expenditures reading that fell below estimates, which will be welcomed by Federal Reserve policymakers eager to cut interest rates before the end of the year.

The European Central Bank (ECB) is expected to cut interest rates later this week, which will not come as a surprise to shake up the market, as it was announced some time ago. However, guidance on future rate cuts could still shake the market.

Overall, the eurozone economy is showing signs of recovery, and inflation remains stable, indicating that there is no need to accelerate with another rate cut as early as July. Instead, the ECB may insist that it continues to be data-driven and argue that it is prudent to allow some time to pass before it starts cutting rates again. On the other hand, this will be a status quo especially for the Euro and could give room for further strength as Eurozone bond yields rise in tandem with U.S. yields, sending the EUR/USD exchange rate sharply higher to 1.09.

Consequently, analysts forecast a cautious easing cycle with only two rate cuts in 2024. The ECB will also publish updated economic forecasts. In the analysts’ view, there is a risk that the ECB will be less restrictive than expected, which would slightly support the EUR/USD.

In reference to the US dollar, according to the results of the economic calendar, Monday’s US PMI reading could generate interest, although it is possible not to attach much importance to the previous market movements of Friday’s relevant employment report. Last month’s U.S. Non-Farm Payrolls came in below 200,000, marking the first such instance since the previous year. All eyes will be on this month’s release to see if this is a one-off or if new employment is cooling. Clearly, this is vital for the United States.

The market estimates nonfarm employment gains of 180,000 jobs with an unemployment rate of 3.9%. Average hourly earnings are anticipated to grow 3.9% year-over-year. Consequently, weak U.S. labor market data could increase the possibility of a first rate cut in July, which would lead to further weakening of the U.S. dollar. The Fed, for its part, is in no hurry to cut rates, so the market is pricing in a full rate cut in December, while September is a 50% option.

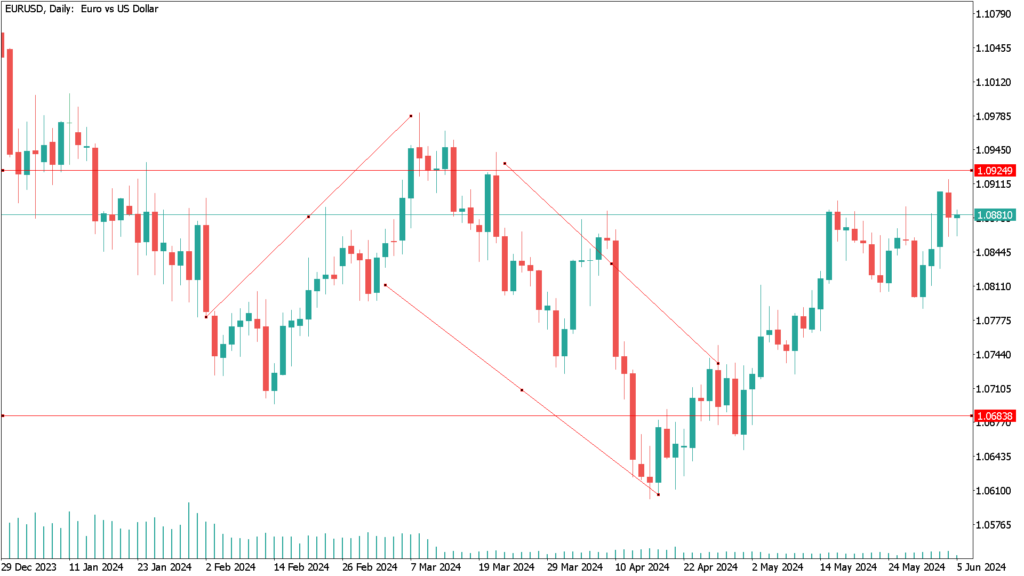

EUR/USD daily technical analysis for June 5th:

According to recent trading, EUR/USD has created a little upside momentum, although it continues to be stuck in a consolidation space. So far, the April high at 1.0885 has not been decisively breached. As a result, support around the 1.0785-1.0800 area continues to hold. Overall, a close above 1.0860 is constructive and eases the path towards a possible test of the 1.09 level and from there to the psychological high of 1.10 in the coming days. This confirms the strength and dominance of the bulls in the trend.

In parallel, it is noted that the daily RSI of the EUR/USD is at 60 and pointing to the upside, while the exchange rate is above its main moving averages. From a technical point of view, the underlying trend looks moderately bullish after breaking the downtrend line set since December. In this regard, bulls will remain confident as long as the key support level around 1.0800 holds. All in all, gains could be sustained as long as markets and investors do not react to ECB policy decisions and US employment statistics.