The EUR/USD has been moving higher, with most of the day’s trading around 1.0744 after two straight sessions of declines, as investors analyzed new economic data and monetary policy estimates ahead of the first round of the French legislative elections on June 30.

Regarding the economic calendar, the most recent business survey from Germany’s Ifo Institute showed a surprising decline in business confidence in June. On the inflation front, preliminary data will be released this week for the world’s leading economies such as Spain, France and Italy.

Annual inflation in Spain is expected to decrease to about 3.3% in June, down from 3.6% in May, while consumer prices in Italy are expected to increase by 0.2% on a monthly basis, the same as in May. From the political point of view, investors are showing concern about the parliamentary elections in France, due to French President Emmanuel Macron’s unexpected early call for elections, which generates some uncertainty. Whether the outcome is positive for the far-right Marine Le Pen or the left-wing alliance, it could have a considerable impact on financial markets, especially if there are major political shifts.

That said, the question right now is: What is the EUR/USD forecast for this week?

There may be signs of a short-term recovery, although it is unlikely to be deep. The euro is likely to remain under pressure ahead of this week’s trading, and a short-term consolidation after five straight weekly losses would be ideal. The recent losing streak is a sign of deeper pressure on exchange rates, so it would be ideal to keep in mind that any period of strength is short-lived, which means that traders who are thinking of buying the dollar should be very smart about doing so.

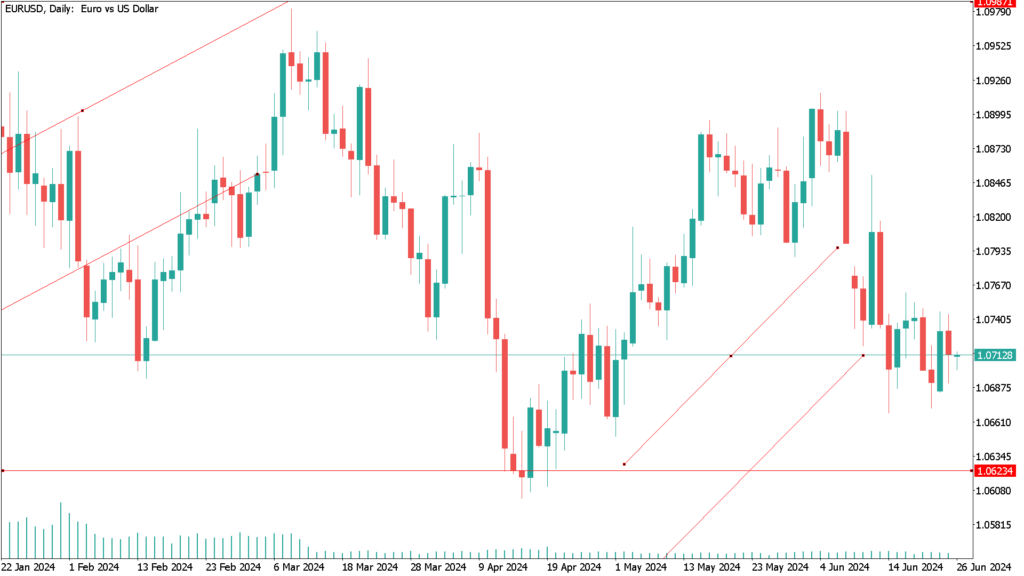

EUR/USD daily technical analysis for June 26th:

We actually see some strength in the coming days. The chart below shows the 100-day moving average at 1.0663, which could be the basis for a return to 1.08 in the imminent outlook. However, caution must be exercised, as it will take two favorable weekly closes before we can talk about a return to the 2024 highs.

Currently, uncertainty regarding the French elections and the rise of far-right parties across Europe, not to mention the sharp rebound in crude oil prices, will continue to weigh on the euro, turning EUR/USD forecasts bearish in the near term. Given the renewed weakness in Eurozone data and concerns over the French elections, we would not be surprised to see the euro/dollar continue to trend lower in the short term. At this point, it could reach a new resistance level below the 1.07 mark. The euro has successfully defended previously broken support levels such as 1.0750 and 1.0790. On the other hand, the psychological support at 1.0500 will continue to serve as a significant level for controlling further downtrends.

As far as the United States is concerned, the continued stock market rally has proven to be a solid source of support for the dollar as global investors seek exposure to this positive performance. According to forecasts, if the stock market continues to rally in the coming days and weeks, the dollar could remain on the offensive.

Clearly, the key data this week is the release of core personal consumption expenditures (PCE) inflation on Friday, which is a key data point in the Federal Reserve’s policymaking process.

Moreover, markets expect the Fed to cut rates by the end of the year. If those forecasts are diluted, the dollar could gain strength. Economic data also needs to continue to beat expectations. Against this backdrop, core CPI is expected to come in at 0.1% month-on-month and 2.6% year-on-year. The consensus for May was for a month-on-month increase of 0.1%, down from 0.2%.

If expectations are exceeded, the US dollar is expected to end the week higher, while the euro/dollar pair is expected to be at its lowest level since mid-April (1.06).