EUR/USD is hovering around 1.0895 in early Asian hours on the first day of the week. The falling US dollar (USD) is helping the pair. Later in the session, German retail sales data for May will be released, followed by the Chicago Fed’s June National Activity Index.

Increased expectations related to the Fed rate cut in September and the vulnerability of the US labor market put pressure on US dollar selling positions. According to CME’s FedWatch tool, financial markets now estimate the likelihood of a move at the Fed’s July meeting at around 5%, and they strongly value a rate cut in September. New York Fed President John Williams said on Friday that he may be supporting a rate cut in the coming months, although he made it clear that this will not happen at this month’s meeting.

As far as the euro is concerned, the European Central Bank (ECB) decision was as expected, introducing no new measures. ECB President Christine Lagarde did not commit to a possible rate cut. She stated that, although inflation in Europe was on a disinflationary path, the ECB would still have to keep rates high. The markets have put the chances of a rate cut in September at around 65%, down from 73% prior to the decision. It is likely that the ECB’s data-driven approach will guide the currency in the short term.

Equally, it should not be forgotten that in the last few hours, President Joe Biden announced that he was withdrawing from the race for the November presidential election. This news may have a negative impact on the dollar. It should not be overlooked that this news may also trigger movements in stocks further into the market sessions.

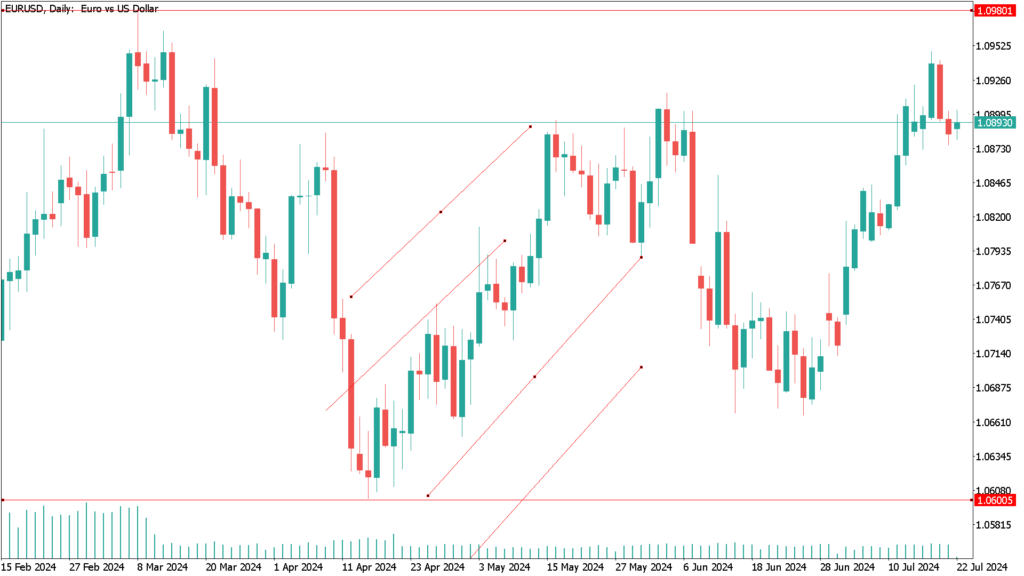

EUR/USD daily technical analysis for July 22nd:

On the technical side, EUR/USD is at the upper end of its recent range, and risk remains skewed to the upside.

On the daily chart, technical readings are in line with the current bearish correction, but far from suggesting that the decline could be prolonged. Technical indicators have moved away from overbought readings, presenting bearish slopes but still within positive levels. The moving averages, on the other hand, remain well below the current level, in line with the prevailing uptrend. A solidly bullish 20 SMA is outperforming the confluent and directionless 100 and 200 SMAs, which is generally a sign of further gains ahead.

EUR/USD has to hold above 1.0800 to keep the uptrend alive, and a break below the level would expose the 1.0740 area on the way to 1.0660. The low of the year at 1.0600 is the major bearish target if the US dollar returns to the spotlight. Resistance lies at 1.0950, followed by the psychological threshold at 1.1000. If the latter limit is breached, EUR/USD could test 1.1080 and then 1.1140.