The EUR/USD is expected to remain under pressure with signs of moderation in the coming days due to the amount of data to be released this week, especially today, Wednesday, when the Eurozone PPI and the Federal Reserve’s interest rate decision and subsequent statement will be released. The EUR/USD has lost ground this week from its July high of 1.0948 and has now had three straight weeks of declines.

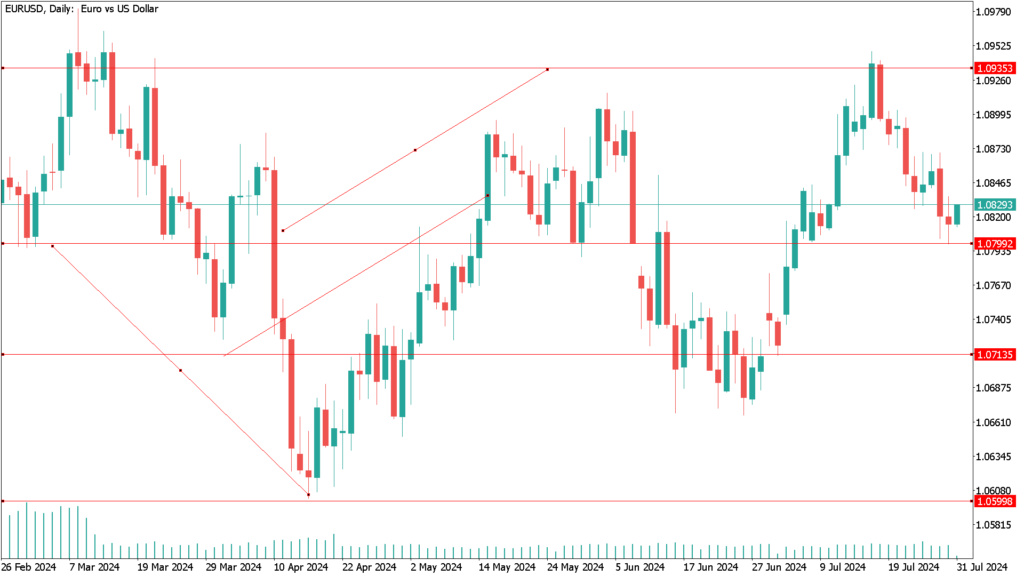

s for the outlook for the currency pair, we expect a slight pullback to near the 50-day moving average at 1.0811 over the next few days. Additionally, this is the possible location for the 38.2% Fibonacci retracement from the high to the 2024 low.

In technical terms, a break of the EUR/USD exchange rate support level at 1.0780 would give the bears control over the trend.

This week, both the Federal Reserve and the European Central Bank will be in the spotlight, especially today, Wednesday, as inflation-related figures were released yesterday, primarily from Germany.

With the European Central Bank expected to cut interest rates again in September, it would take a major new data release to have a long-lasting impact on the Euro. Conversely, this week’s volatility will likely be driven by the dollar. The Federal Reserve will make its policy decision later today. Additionally, it seems that there will be no change in US rates.

Expectations are for an expansionary stance in line with estimates for the first interest rate cut in September. Currently, the market seems predisposed to such an outcome, which would translate into the dollar rising if the Fed leaves any doubt about whether it will begin its rate-cutting cycle in September. Additionally, the Fed is expected to continue its strategy of highlighting concerns that keeping interest rates unchanged for an extended period could significantly impact the labor market.

This is consistent with the Fed’s statement that it believes it can afford to cut US interest rates before inflation falls to its 2% target. On Friday, the most notable event for the dollar will be the release of the US employment report. If the data falls below expectations, the market will anticipate further easing of Fed monetary policy in the months ahead, which will weigh on the dollar.

July US nonfarm payrolls are expected to show an increase of 178,000 jobs, with the unemployment rate at 4.1%. In June, the figure was higher than expected, at +206,000 jobs.

EUR/USD Daily Technical Analysis for July 31st:

There is no change in our technical view on the performance of the euro against the dollar. The overall trend remains bearish, and a break of the 1.0800 support is feasible, which will consolidate control by the bears, potentially leading to further losses.

Technical indicators will move towards strong oversold levels on the daily chart if the euro/dollar price approaches the support levels of approximately 1.0735 and 1.0600. For the same time frame, the psychological resistance 1.1000 will continue to have the most relevance for the upward shift of the overall trend.