EUR/USD is edging lower in Monday’s Asian session, slipping to around 1.1240 after gains in the previous trading day. The Euro (EUR) is under pressure following comments from European Central Bank (ECB) policymaker Olli Rehn, who suggested the ECB may consider cutting interest rates at its next meeting—provided upcoming projections confirm a sustained disinflationary trend and weakening economic activity.

Despite the dovish ECB stance, the pair found some support from renewed optimism over U.S.–China trade talks in Geneva. Both parties reported “substantial progress” after two days of negotiations aimed at easing tensions. Chinese Vice Premier He Lifeng described the talks as “an important first step” toward stabilizing bilateral relations, while U.S. Treasury Secretary Scott Bessent also noted meaningful advances.

Looking ahead, market attention turns to Washington’s response to the European Commission’s proposed retaliatory measures against U.S. tariffs. On Thursday, the Commission launched a public consultation on potential tariffs targeting up to €95 billion worth of U.S. goods, should trade discussions collapse.

Meanwhile, uncertainty looms over the U.S. economic outlook. Federal Reserve (Fed) officials have voiced concerns about stagflation. Governor Michael Barr warned that rising tariffs could exacerbate inflation by disrupting supply chains while simultaneously weakening growth and raising unemployment. Investors remain on alert, wary that further escalation in trade frictions could significantly challenge the U.S. economy.

EUR/USD Daily Technical Analysis for May 12th

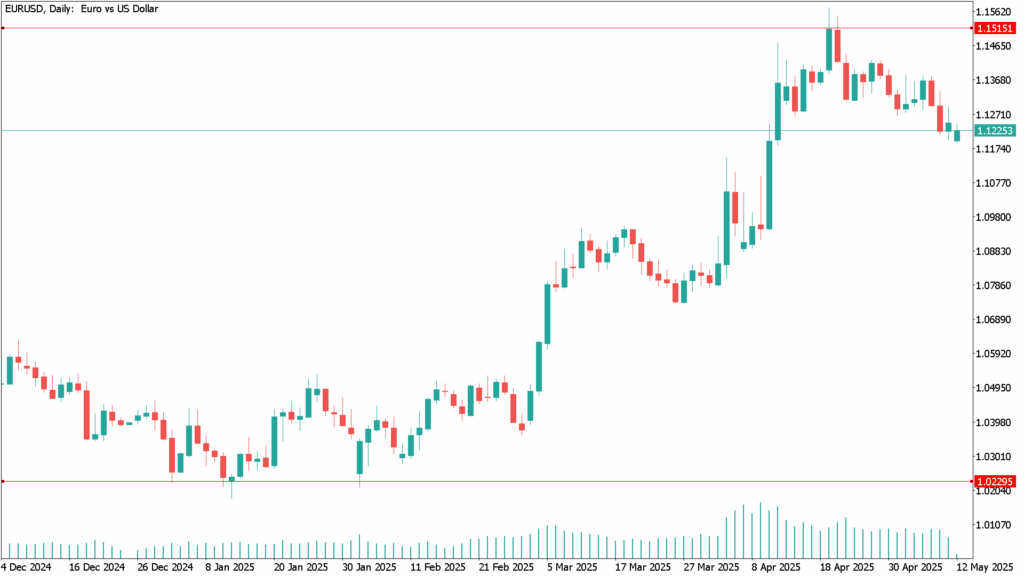

EUR/USD remains capped below the 2025 peak of 1.1572, set on April 21. Key resistance levels are seen at the 1.1600 psychological barrier and the October 2021 high at 1.1692.

On the downside, initial support is located at the 55-day Simple Moving Average (SMA) near 1.1005, followed by the more robust 200-day SMA at 1.0791. A deeper floor sits at the March 27 weekly low of 1.0732.

Momentum indicators point to the potential for further corrective movement. The Relative Strength Index (RSI) has cooled to neutral levels around 52, while the Average Directional Index (ADX) at 41 signals strong—but possibly fading—trend strength.