The EUR/USD pair extended its winning streak for a fourth consecutive session, rising 0.39% to trade at 1.1619—just below the yearly high of 1.1641. The advance was driven by broad U.S. dollar weakness, spurred by easing geopolitical tensions after Israel and Iran agreed to a ceasefire. This improvement in global risk sentiment weighed on the greenback.

The U.S. Dollar Index (DXY) dropped 0.47%, nearing weekly lows at 97.70, as optimism grew over a possible de-escalation in the Middle East. Adding to the dovish mood, The New York Times reported that recent U.S. strikes on Iran did not damage nuclear facilities, softening the market’s reaction to earlier fears.

Meanwhile, Wall Street traded higher despite hawkish signals from Federal Reserve Chair Jerome Powell. Speaking before the U.S. House of Representatives, Powell reiterated that interest rates remain “modestly restrictive,” though he opened the door to potential cuts if inflation moderates. Other Fed officials echoed a wait-and-see approach, citing tariff concerns and slowing growth.

In economic data, U.S. Consumer Confidence fell sharply in June to 93.0 from 98.0, missing expectations of 100. The Conference Board noted that the decline was broad-based, reflecting weaker sentiment on both current conditions and future expectations.

In Europe, Germany’s IFO Business Climate Index rose to 88.4 in June—its sixth consecutive monthly gain—slightly exceeding forecasts. Business expectations improved as well. However, the euro showed limited reaction to the data. ECB speakers offered mixed views: François Villeroy signaled openness to further rate cuts if inflation expectations remain subdued, while Peter Kazimir shifted to a more neutral stance, suggesting rates may stay on hold.

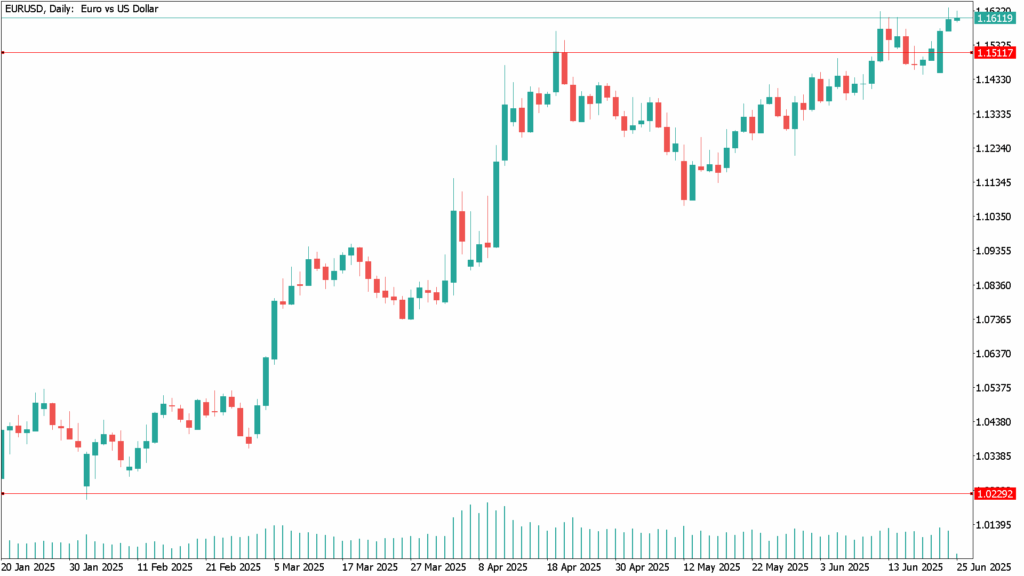

EUR/USD Daily Technical Analysis – June 25

The pair maintains a bullish structure after setting a year-to-date high at 1.1641. A daily close above 1.1650 would confirm further upside, opening the path toward 1.1700 and possibly 1.1800. On the downside, support lies at 1.1600, followed by 1.1550 and 1.1500. Breaching these levels could expose the weekly open at 1.1454.