The EUR/USD edged up during the session, trading at 1.1724 and gaining 0.14%, as the U.S. dollar lost some of its earlier strength. The shift followed President Trump’s renewed call for the Federal Reserve to cut interest rates and his decision to postpone the July 9 trade deadline to August 1.

Late-day sentiment soured on Wall Street as trade uncertainty resurfaced. U.S. Commerce Secretary Howard Lutnick told CNBC that 15–20 additional letters regarding trade actions are expected soon. At the same time, Trump’s threats to expand tariffs to pharmaceuticals, semiconductors, and copper added to investor caution.

On the data front, the NFIB Small Business Optimism Index showed a slight decline in confidence among U.S. small businesses.

Euro Supported by Easing EU Tensions

The euro found some support as the U.S. held back from targeting the European Union with further tariffs. President Trump acknowledged progress in talks with the EU, describing recent interactions as “very nice.”

With little scheduled on the U.S. calendar, traders are focused on the upcoming release of June’s FOMC minutes. In Europe, ECB officials—including Vice President Luis de Guindos, Chief Economist Philip Lane, and Joachim Nagel—are expected to deliver remarks that could shape expectations.

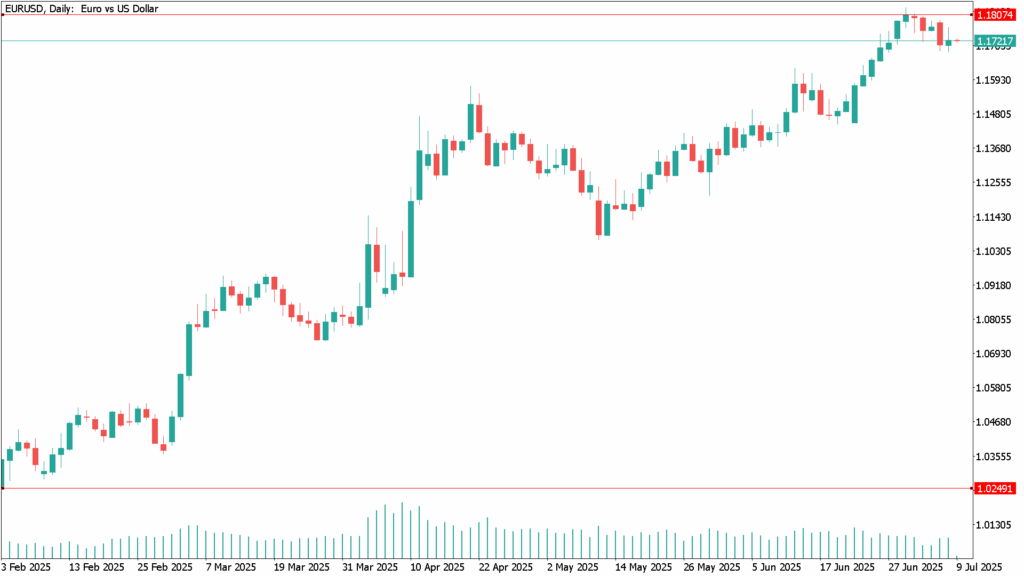

EUR/USD Daily Technical Analysis – July 9

EUR/USD remains range-bound, holding above the 1.1700 level. The RSI has flattened, suggesting a lack of clear directional momentum. A break above the July 7 high of 1.1789 could pave the way toward 1.1800 and the YTD peak at 1.1829. On the downside, key support sits at the 20-day SMA at 1.1649, with further losses potentially extending to 1.1600 and the 50-day SMA at 1.1448.