Recently, currency markets have been under pressure due to a much better performance by bonds, following a report that commented that U.S. companies have created more job opportunities and exceeded economists’ expectations. While this strength is a boon for workers and keeps the risk of a recession at bay, the concern could sustain some direct upward pressure on inflation. Additionally, this could set up a longer wait for the Fed to begin cutting interest rates.

Hopes about the possibility of these cuts, which could help relieve pressure on the economy and boost investment, were a key reason for the U.S. stock market’s rise to all-time highs.

For its part, the yield on 10-year Treasury bonds showed a significant jump last week, from 3.88% to 4.02% after the Fed’s announcement.”

Likewise, the current question in the precious metals market is whether there is more upside than downside. Can the U.S. economy become more robust in the coming days and compensate for the non-lowering of interest rates? The market cannot answer these questions right now, which invites us to be more attentive to how the metals market, currency, and stock market behave.

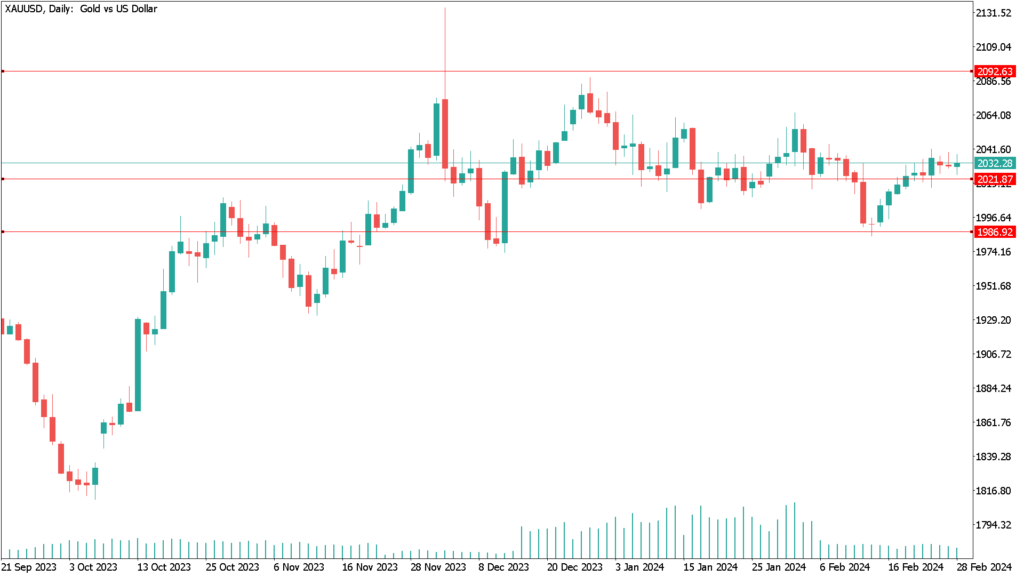

Daily Technical Analysis XAU/USD 6 Feb:

The latest sell trades have failed to dampen the expected performance, although the XAU/USD continues to trend higher, and external factors continue to favor the price of this ratio.

This could be a sign that investors still control the market and that gains in the XAU/USD may be more prolonged as a result of the current geopolitical tensions along with increased gold purchases by central banks, which is a signal by central banks to calm tensions after the tightening of some monetary policies.

That said, support levels for XAU/USD can be as follows: USD 2023, USD 2010, and USD 1985.

As for resistance, the barrier may be located at USD 2065. We must remain cautious and monitor the metals behavior closely in the coming days to see if the upward trend for XAU/USD continues.