EUR/USD technical indicators are likely to move towards oversold saturation levels. At the start of April trading, the EUR/USD is moving below the psychological support level of 1.0800 with losses extending to 1.0767, its lowest level in a five-week span.

This behavior is seen after first quarter losses reached 2.3% amid speculation of a possible interest rate cut by the European Central Bank (ECB). The market currently expects this to occur in June, although some have begun to think that a cut as early as this April is a possibility.

Some ECB members have stated that the time has come to insure against growth risks. To achieve this, they must begin to cut interest rates. Additionally, they expect certain monetary conditions to be met to initiate the easing of monetary policy, such as inflation returning to its target level of 2%, which many estimate will be achieved next year.

the number of rate cuts by the central bank, most members expect a total of four cuts this year, culminating in a cumulative 100 basis point reduction by the end of the year. However, there is still no consensus among all central bank officials, as some continue to believe that they should be more cautious and less lax with rate cuts

The latest inflation data from Italy and France have lent support to the idea that the ECB may start cutting rates as soon as possible. With the consumer price index reaching the European Central Bank’s proposed target of 2%, most policymakers have given their backing to ECB President Christine Lagarde that the first rate cut will come in June.

Following the consumer price reports released the previous week in Spain, France, and Italy, the economic calendar suggests that new challenges may arise, potentially pressuring the euro. On Tuesday, German inflation is expected to show signs of weakness towards the 2% target. On the same day, the ECB will also release its survey of consumer expectations.

Also on Wednesday, inflation data for the eurozone will be released. The results, which economists expect to be between 2.5% and 3% for the core measure that does not take into account volatile items such as food and energy, could motivate officials to cut rates in the coming months as they analyze how their policy is holding back growth.

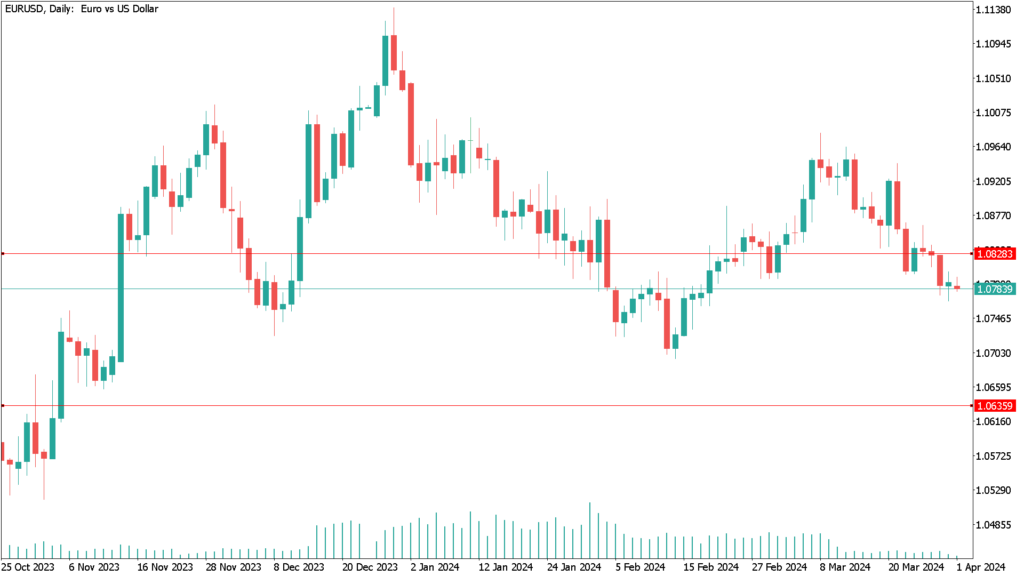

Daily technical analysis EUR/USD April 1st

The bearish behavior of EUR/USD can be expected to continue below the psychological support level of 1.0800 until the markets along with investors react to the US jobs data announcement at the end of the week. This will have a major impact as it may determine the future of US interest rates and also impact the behavior of the EUR/USD pair.

The nearest support levels for the EUR/USD for the downtrend are 1.0730, 1.0650, and 1.0580, in that order. Technical indicators will move towards oversold levels. On the other hand, the key psychological resistance level is 1.1000, especially if the trend shifts to the upside.