EUR/USD rises near 1.0750 as Le Pen’s National Rally leads the first round. The pair continues its winning streak as the latest inflation data increase the chances of Fed rate cuts this year.

Core inflation in the US rose to 2.6% in May, down from 2.8% in April. Meanwhile, the euro received support as Marine Le Pen’s National Rally confirmed her position as the leading political force in France.

EUR/USD extended its gains for the third day in a row, trading near 1.0750 during the early part of Monday. Speculation that the Federal Reserve may cut interest rates this year is weighing on the U.S. dollar and supporting the EUR/USD.

According to the U.S. Bureau of Economic Analysis, U.S. inflation slowed on Friday to its lowest annual rate in more than three years. The U.S. personal consumption expenditures (PCE) price index rose 2.6% year-on-year in May, up from 2.7% in April, meeting market expectations. Core PCE inflation also recorded a year-on-year rise of 2.6% in May, down from 2.8% in April, matching estimates.

According to Mary Daly, President of the Federal Reserve Bank of San Francisco, monetary policy is having an effect. However, it is premature to say when it will be appropriate to cut the interest rate. Daly noted, “If inflation remains persistent or falls slowly, rates would have to be higher for longer,” according to Reuters.

On the euro front, Olli Rehn, a member of the European Central Bank’s (ECB) Governing Council, signaled last week that the central bank could cut interest rates two more times this year. According to recent data, France’s annual inflation rate slowed to 2.5%, in line with expectations, while Spain’s fell to 3.5%, slightly above expectations. In contrast, Italy’s inflation accelerated to 0.9%, as expected. In addition, German consumer price index (CPI) data will be released on Monday.

In France, Marine Le Pen’s National Rally confirmed its status as the country’s leading political force during the first round of the legislative elections, which recorded the highest turnout in the last three decades. According to France 24, Le Pen’s party won a clear victory, without being decisive, which maintains uncertainty regarding the second round, scheduled for July 7.

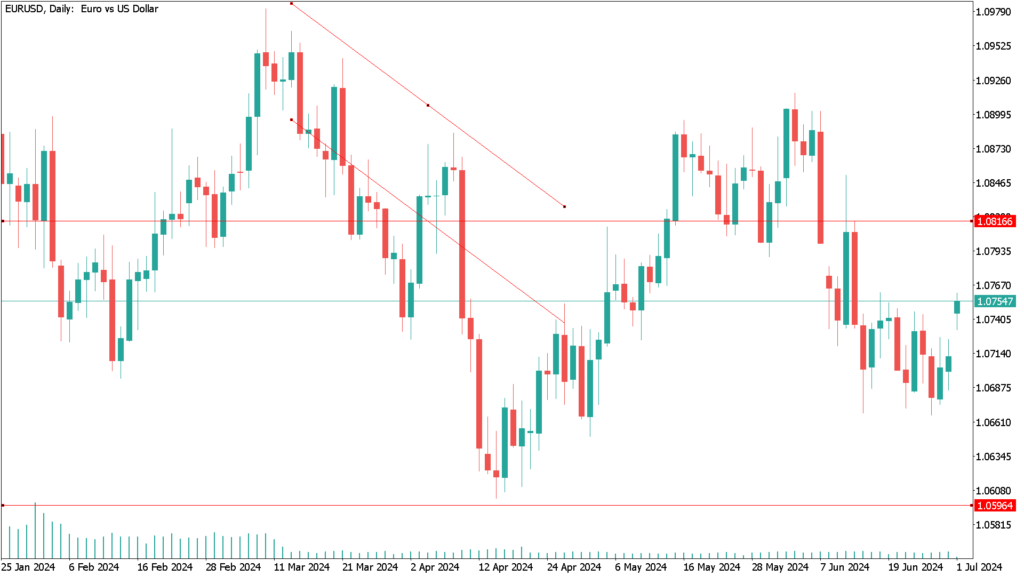

EUR/USD daily technical analysis for July 1st:

For now, it can be said that if the EUR/USD pair continues to gain ground, it could touch the psychological resistance level of 1.0800. We must also wait to see how the news that Le Pen is consolidating her position as the most powerful political force in France is received. In addition, it should not be overlooked that at this time the US Federal Reserve has accelerated its efforts to tighten monetary policy. This week’s U.S. June payrolls report will be key because if it does not meet expectations, it may affect the EUR/USD pair and generate a downtrend that could move towards a psychological level near 1.0500.

Nothing is certain yet. At the time of writing, the pair continues its winning streak, as previously mentioned, due to the latest inflation data in the United States, which increases the chances of interest rate cuts by the Fed for this year. It should not be forgotten that several members of the Fed have said that for now they are only considering a rate cut if they see inflation slowing at the pace they expect. For its part, the market is still debating the possibility of two cuts, one for September and another for the end of the year.