EUR/USD is rebounding from its previous session’s losses, trading around 1.1370 during Monday’s session. The pair gains ground as the U.S. Dollar struggles following legal developments surrounding former President Donald Trump’s trade policies.

On Thursday, the U.S. Court of Appeals ruled in favor of allowing Trump’s tariffs to proceed, temporarily supporting the executive’s trade stance. However, a day earlier, a three-judge panel at the Court of International Trade in Manhattan had declared that Trump overstepped his authority by imposing broad import tariffs, deeming his April 2 executive orders unlawful.

Adding to the market’s caution, Trump stated during a Friday rally in Pennsylvania that he intends to double tariffs on steel and aluminum imports, aiming to exert more pressure on global producers. “We are going to be imposing a 25% increase—from 25% to 50%—on steel tariffs,” he said, according to Reuters.

In response, the European Commission (EC) warned on Saturday that the EU is prepared to retaliate against Trump’s proposed tariff hike, escalating tensions between two major global economies.

Previously, Trump had postponed the tariff deadline on EU imports from June 1 to July 9. Brussels, in turn, agreed to accelerate trade negotiations with Washington in an effort to avoid a transatlantic trade war.

Meanwhile, the European Central Bank (ECB) remains cautious. ECB Governing Council member Klaas Knot recently said the inflation outlook in Europe remains uncertain, complicating the central bank’s next steps. Fellow ECB policymaker François Villeroy de Galhau added that “policy normalization in the Euro area is probably not complete.”

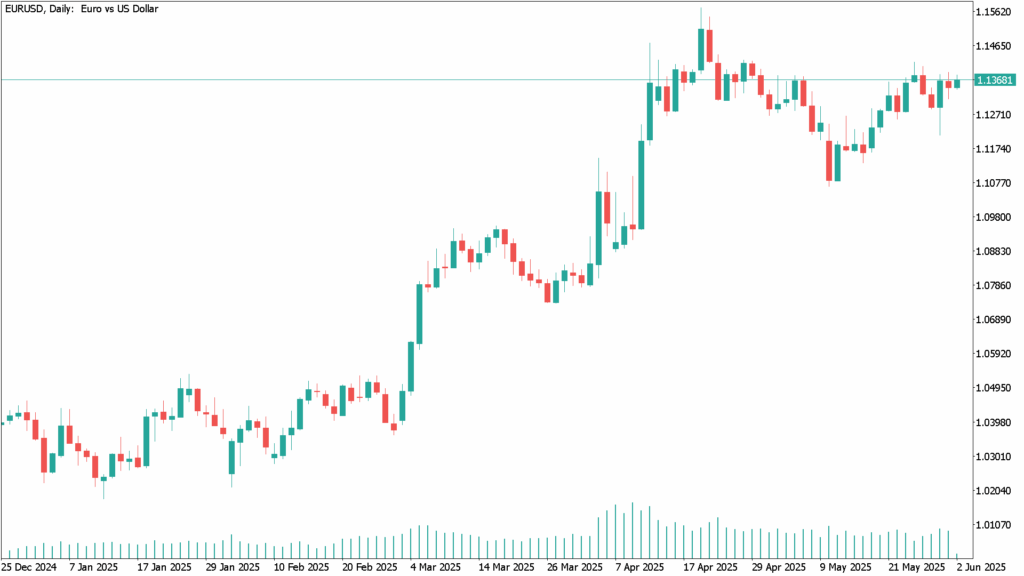

EUR/USD Daily Technical Analysis for June 2nd

EUR/USD continues to face resistance below its 2025 peak of 1.1572 (April 21). A breakout above this level would expose the next major barrier at 1.1600, followed by the October 2021 high at 1.1692.

On the downside, initial support lies at the 55-day Simple Moving Average (SMA) around 1.1165, with stronger support levels at the 200-day SMA at 1.0813 and the March 27 low of 1.0732.

Momentum indicators suggest potential consolidation ahead. The Relative Strength Index (RSI) has eased to around 54, while the Average Directional Index (ADX) hovers near 21, pointing to weakening trend strength.