According to the economic calendar results, headline and core inflation rates increased to 2.6% and 2.9% in May, higher than expected. This set of data suggests that the economic backdrop could benefit from a looser monetary policy from the Federal Reserve. Underlying prices for personal consumption expenditures, the Fed’s preferred measure of inflation, increased by about 0.2%, a slower pace than before, raising hopes that inflation may be nearing its target.

Additionally, personal spending and income rose at a slower pace, easing past perceptions of a resilient U.S. economy.

According to analyst platforms, European stock indices ended a volatile session mixed as investors analyzed economic data for signals about major central bank policies. Reflecting the inflation concerns, the Stoxx 50 index fell about 0.1% to end at 4,977, while the Stoxx 600 index rose about 0.2% to close at 528. According to official data from the ECB, both headline and core inflation rates rose more than expected, which suggests that the downward trend in inflation in Europe is unlikely to be sustained as long as inflation continues.

Overall, the ECB remains poised to cut policy rates when it meets later this week, although the notorious differences between hawks and doves in the ECB’s Governing Council have increased uncertainty about how much the bank might cut after the third quarter. Meanwhile, weak GDP growth in the United States has bolstered bets that the Federal Reserve will ease monetary policy in 2024, thus buoying stock markets globally.

On the other hand, large technology stocks pushed the Stoxx 50 lower, with ASML, SAP, and Prosus falling by about 1.1% and 2.3%, respectively. The Stoxx 50 rose by a corresponding 1.1% in May, while the Stoxx 600 rose by 2.6%.

Overall, ECB officials, led by President Christine Lagarde, say they are comfortable setting a different course than the Fed, even at the risk of weakening the currency and eventually stoking inflation. Moreover, the degree of officials’ tolerance is likely to figure prominently in their discussions on further easing, all the more so after recent reports pointed to persistent consumer price pressures. The latest data, released last Friday, indicated that the main inflation indicator rose by surprise in May for the first time in a year.

The ECB is already sensing how diverging policy expectations have begun to influence global markets. As a result, the euro has fallen to its lowest level against the pound in almost two years on expectations that the Bank of England will lag the ECB in rate cuts.

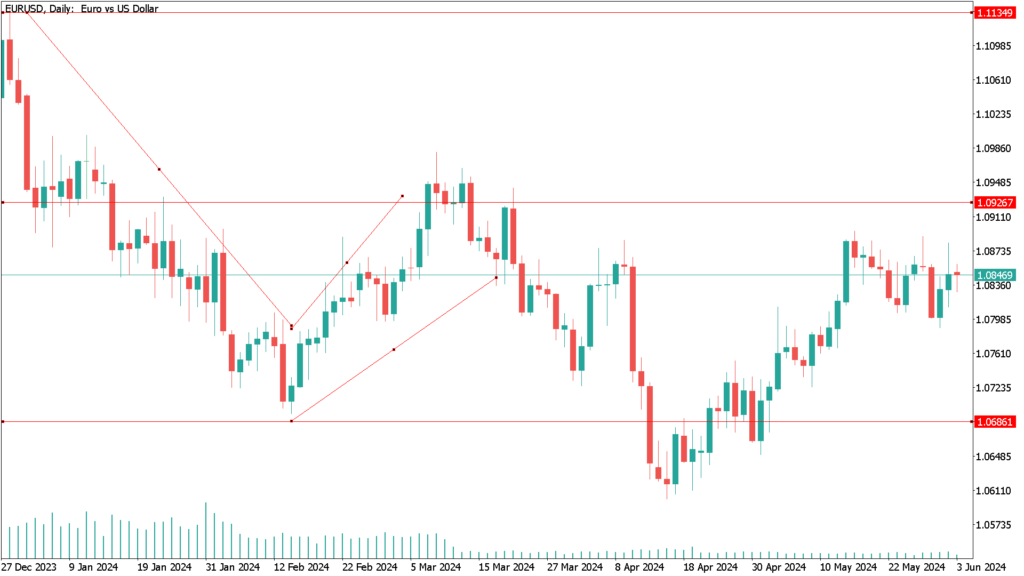

EUR/USD daily technical analysis for June 3rd:

According to the daily chart, the bulls seem to be in control of the EUR/USD, which may lack momentum. However, their control could strengthen if it moves towards the psychological resistance levels of 1.0920 and 1.3000, respectively. Conversely, and in the same time frame, a move towards the 1.0770 support level will be crucial for further trend control by the bears. Ultimately, performance may remain in tight ranges until EUR/USD’s reaction to the ECB announcements and US employment figures.