The EUR/USD remained above the 1.0700 barrier throughout Tuesday. There were no surprises from either Lagarde or Powell for the markets.

The focus will be on US data and the FOMC Minutes on Wednesday. Additionally, the ISM Services PMI survey will be released on Wednesday, which could also influence the market. It should be remembered that if the market raises its estimates for a rate cut in September after this data, the dollar could weaken. Any disappointment would serve to strengthen the greenback. Today, the market is forecasting a 56% chance of a rate cut in September. Likewise, the most relevant data of the week is the Non-Farm Payrolls.

That said, the dollar’s slight decline encouraged the U.S. dollar index to hold near 105.80 on Tuesday, extending its consolidation status so far this week.

This small rise in the dollar also caused the EUR/USD to remain in a trading zone between 1.0730 and 1.0740 for the first part of the week, as investors continued to digest the results of the French elections held on June 30, as well as the meeting of President Christine Lagarde and President Jerome Powell at the ECB Forum in Sintra, Portugal.

In this regard, Lagarde pointed out that the euro zone has made significant progress on its path to disinflation, although there are still uncertainties related to economic growth estimates. For his part, Powell indicated that the Fed requires more data before it can begin to consider interest rate cuts, with the aim of confirming whether the latest inflation readings are indeed showing price pressures.

A political event that may affect the EUR/USD next week on the European side is the early run-off election in France scheduled for July 7. It remains to be seen how these results will affect the pair and how the market will react to the possibility of the far-right party’s victory led by Marine Le Pen.

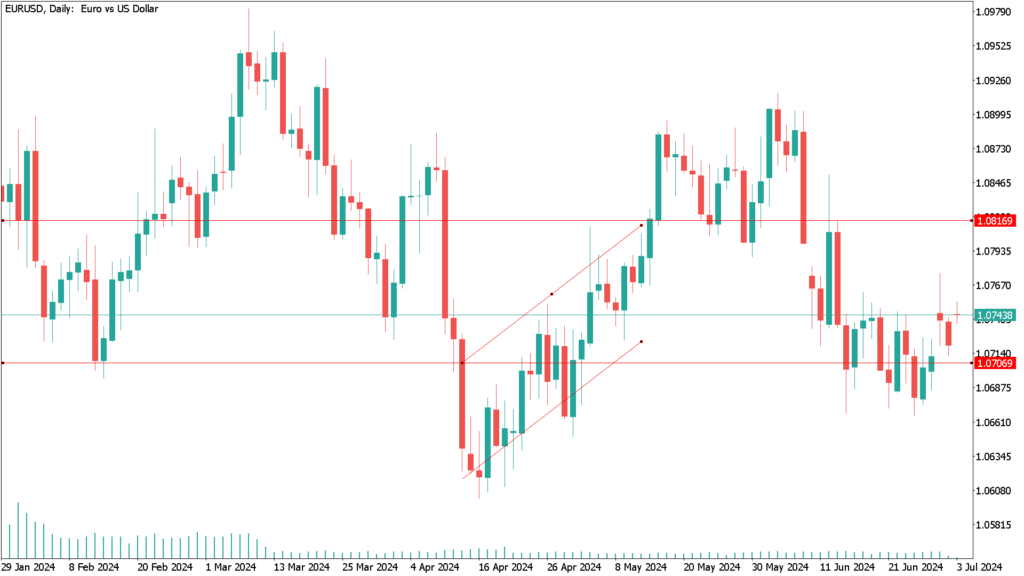

EUR/USD daily technical analysis for July 3rd:

The EUR/USD rallied over the weekend and on Tuesday after Jerome Powell’s speech where he announced that the bank had made significant progress on inflation.

Although the pair may break below 1.0790, a more technical analysis suggests it could even break below the psychological resistance of 1.0720. If the Fed minutes reading has a positive impact on the pair, it can reach 1.0800.

EUR/USD is below the 200-day exponential moving average (EMA) near 1.0790, indicating that the overall trend is bearish. The 14-period RSI oscillates in the 40.00-60.00 range, hinting at indecision among market participants.