The EUR/USD pair retreated on Tuesday after reaching a six-week high of 1.1454, pressured by renewed concerns over the U.S.–China trade dispute and a strengthening U.S. dollar. The pair trades at 1.1379, down 0.52%, as the greenback regains ground.

Trade Tensions and Economic Data Support the Dollar

U.S. President Donald Trump is reportedly planning to speak with Chinese President Xi Jinping this week, according to Reuters, offering a potential path to de-escalate ongoing trade tensions. Meanwhile, Wall Street remains in positive territory on the back of these developments.

Stronger-than-expected U.S. economic data further boosted the dollar. April’s Job Openings and Labor Turnover Survey (JOLTS) climbed to 7.39 million, beating forecasts of 7.10 million and signaling continued labor market strength. However, factory orders dropped by 3.7%, reflecting pressure on the manufacturing sector due to rising tariffs.

Trade uncertainty continues to weigh on sentiment. White House Press Secretary Karoline Leavitt confirmed that President Trump will sign an executive order to double tariffs on steel and aluminum, effective Wednesday.

Euro Weighed Down by Soft Inflation Figures

Across the Atlantic, Eurozone inflation data added to the euro’s weakness. The Harmonized Index of Consumer Prices (HICP) for May fell to 1.9%, slipping below the ECB’s 2% target for the first time in eight months. Core inflation also dropped to 2.3% from 2.7%, reinforcing expectations of a 25-basis-point rate cut at the upcoming European Central Bank meeting.

This week’s Eurozone calendar includes the ECB’s rate decision and a press conference by President Christine Lagarde, while the U.S. docket is packed with labor market data, including May’s ADP Employment Report, Initial Jobless Claims, and the Nonfarm Payrolls release.

EUR/USD Market Drivers: Dollar Strength and ECB Expectations Shift Momentum

- EUR/USD retreats below 1.1400, as U.S. JOLTS job openings surprise to the upside, hitting 7.39 million in April versus a revised 7.20 million in March.

- U.S. Factory Orders declined 3.7% in April after a 4.3% rise in March, worse than the expected 3.1% drop.

- Federal Reserve commentary reflects caution. Governor Lisa Cook noted policy is well-positioned amid inflation risks from tariffs, while Chicago Fed President Austan Goolsbee highlighted the need to observe tariff impacts before acting.

- Eurozone inflation undershoots the ECB’s target. Headline HICP at 1.9% and core at 2.3% YoY increases the odds of a rate cut this week.

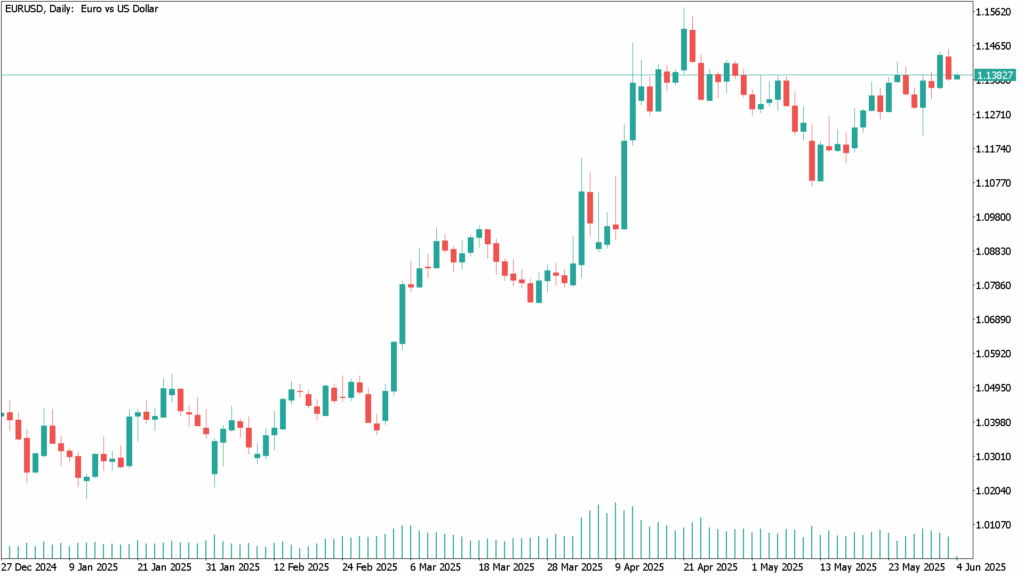

EUR/USD Daily Technical Analysis – June 4

The EUR/USD maintains a bullish bias despite the current pullback. The daily RSI remains in positive territory but is showing signs of exhaustion, suggesting the potential for a deeper correction.

Support Levels to Watch:

- A break below the June 2 low at 1.1344 could open the door to 1.1300

- Further downside targets include the 20-day SMA at 1.1278 and the 50-day SMA at 1.1218

- A sustained decline may reach 1.1200

Resistance Levels:

Above that, the next target is the YTD peak at 1.1573, last seen on April 21The EUR/USD pair retreated on Tuesday after reaching a six-week high of 1.1454, pressured by renewed concerns over the U.S.-China trade dispute and a strengthening U.S. Dollar. The pair trades at 1.1379, down 0.52%, as the Greenback regains ground.

If EUR/USD reclaims 1.1400, bulls could aim for the recent high of 1.1454. Above that, the next target is the YTD peak at 1.1573, last seen on April 21