The most recent behavior of the British Pound (GBP) can serve as a warning that February is generally a difficult month for the British Pound. This means that one should look for the possibility of losses on long positions this month.

Last week, various economic data releases from both the UK and the US impacted GBP/USD. Given the expectation of a challenging month, observing the pair’s behavior in the coming days will be crucial.

Analysts also believe the pound may continue to increase its market value against the G10 currencies. One piece of data that may fuel the pound’s valuation is that according to the Office for National Statistics, the unemployment rate in the UK fell to 3.9% in the three months leading up to November from 4.2% in the three months leading up to August. The growth and strengthening of the labor market is likely to come as a surprise to the Bank of England (BoE).

In essence, this data will support UK interest rates and the performance of the GBP/USD pair despite high domestic inflation pressures, causing rates to remain on hold for longer. Last week, the Bank of England’s monetary policy report estimated an unemployment rate near 4.3% for the fourth quarter.

Similarly, wages will likely remain high as long as the unemployment rate is lower than the Bank of England’s estimates. This could lead to further inflationary pressures at home and also prompt the bank to hold rates.

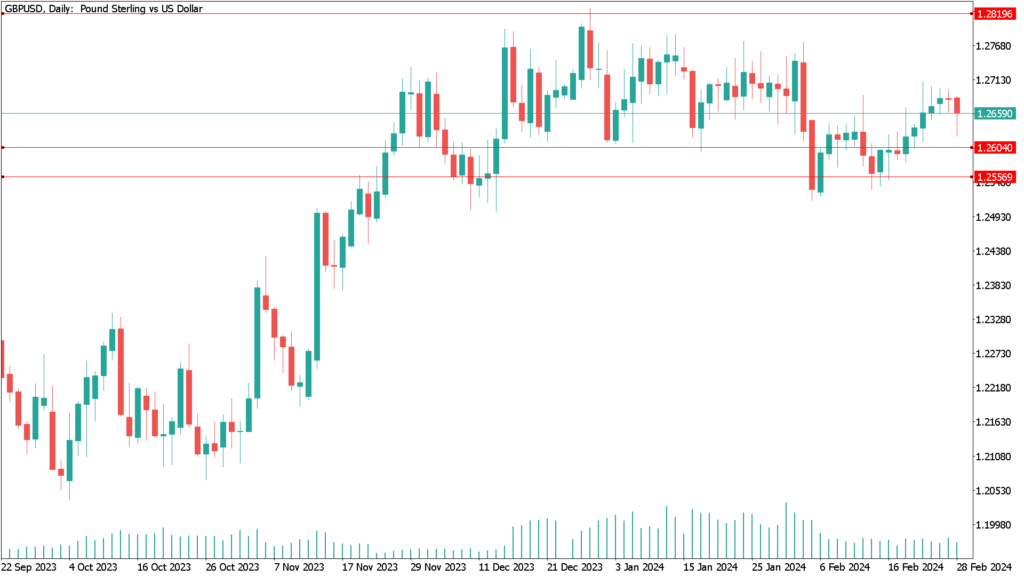

Daily Technical Analysis GBP/USD February 7th

Despite yesterday’s bounce, the GBP/USD price action continues to trend lower, and the break of the 1.2600 support will continue to favor those interested in short positions. At the same time, this may lead the price to new buying levels. The 1.2550 support level should be closely watched. A move below this level could present an ideal buying opportunity. However, the approach varies with individual trading strategies and objectives.

The GBP/USD pair may not experience significant volatility, as no key data releases from the UK or the US are expected to directly affect its price.