The EUR/USD pair traded sideways on Tuesday, establishing a near-term consolidation range around the key 1.1300 level as market participants await a fresh catalyst. Investor focus remains firmly fixed on the Federal Reserve’s upcoming interest rate decision, which is widely expected to shape market direction for the remainder of the week.

The Fed’s policy announcement on Wednesday is the central event on the economic calendar, with most analysts anticipating that interest rates will be held steady. However, traders will be watching Fed Chair Jerome Powell’s accompanying remarks for any subtle shifts in tone that could hint at the beginning of a rate-cutting cycle sooner than currently forecast.

The central bank has come under increasing pressure to ease monetary policy. While financial markets have grown more vocal in their calls for lower borrowing costs, the Trump administration has taken an even stronger stance, arguing that rate cuts are necessary to reduce the burden of U.S. debt servicing. Nevertheless, this perspective clashes with the Fed’s dual mandate to support maximum employment and maintain stable inflation—objectives that remain central to its decision-making process.

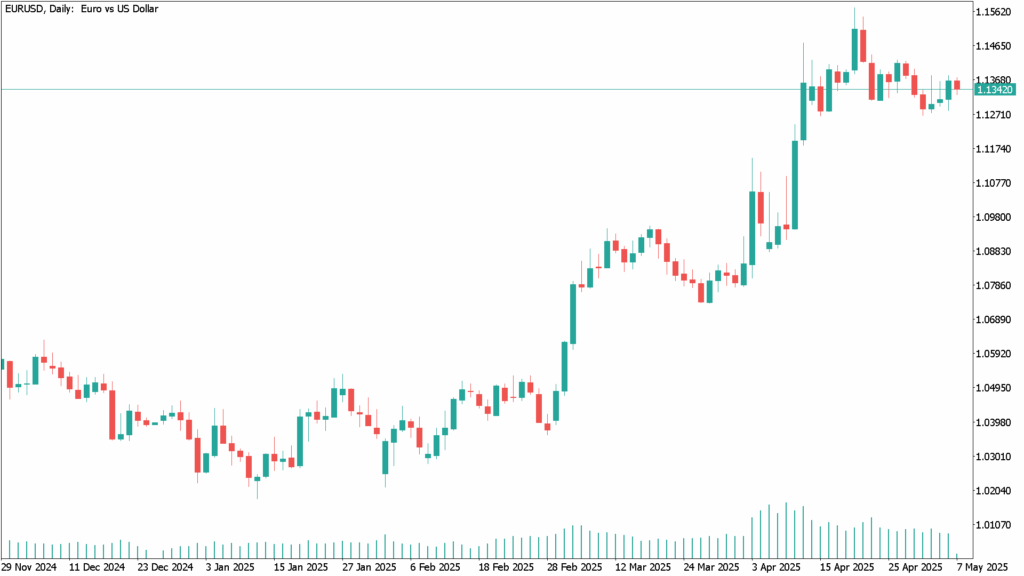

EUR/USD Daily Technical Analysis for May 7th:

From a technical standpoint, EUR/USD appears to have found a temporary floor just above the 1.1200 mark, with support holding firm near 1.1300. After retreating from multi-month highs slightly above 1.1500, the pair’s downside pressure remains limited as traders await more clarity on macroeconomic direction.

With volatility expected to pick up following the Fed’s announcement, the euro may break out of its current holding pattern. Until then, range-bound trading is likely to persist, with the path of least resistance hinging on upcoming central bank signals.