The EUR/USD pair edged lower to around 1.1780 during Monday’s session after posting gains the previous day, pressured by renewed trade tensions following remarks from U.S. Treasury Secretary Scott Bessent. The pair struggles to maintain upward momentum as markets assess the likelihood of tariff escalation.

Bessent stated on Sunday that President Trump is preparing to send letters to certain trade partners, warning that tariffs could revert to April 2 levels by August 1 if negotiations stall. Although he clarified that August 1 is not a firm deadline, Bessent emphasized it as a window for additional renegotiation efforts. U.S. Commerce Secretary Howard Lutnick added that the new tariffs will take effect on August 1, with Trump expected to finalize the rates and dispatch up to 15 letters on Monday. Most trade arrangements are anticipated to be concluded by July 9.

Meanwhile, the European Commission signaled ongoing progress toward a U.S.–EU trade agreement, aiming to avoid harsh tariffs before the looming July 9 deadline. According to Bloomberg, some EU automakers and member states are advocating for a compromise that would involve greater U.S. investment in exchange for tariff relief.

On the European side, potential downside in EUR/USD may be mitigated by hawkish comments from European Central Bank (ECB) President Christine Lagarde. She reiterated the ECB’s commitment to its inflation mandate, stating, “We will do whatever we must do,” which helped provide modest support for the euro.

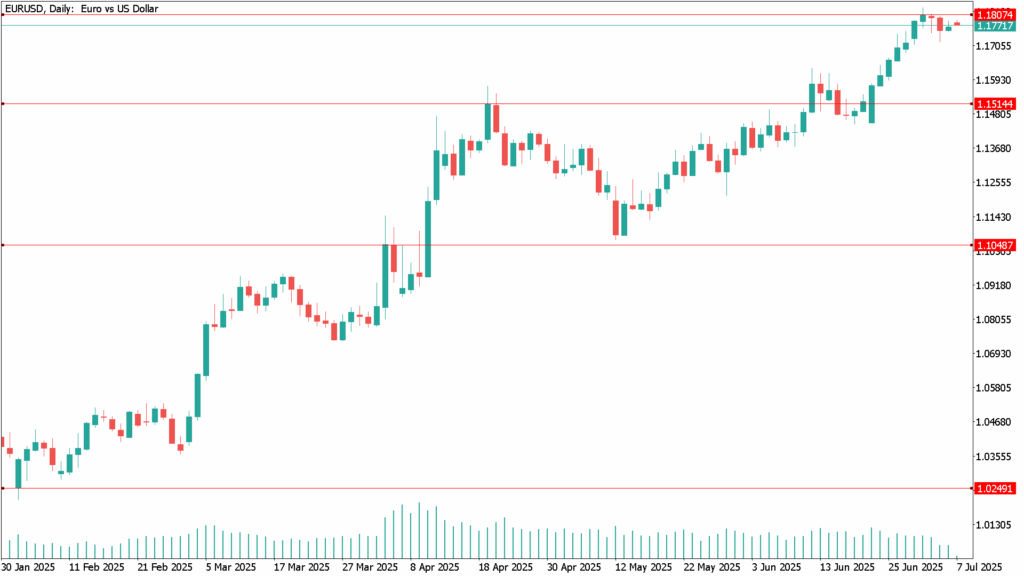

EUR/USD Daily Technical Analysis – July 7

Technically, EUR/USD maintains a bullish daily bias, continuing to trade above all key moving averages. The 20-day Simple Moving Average (SMA) near 1.1600 offers solid technical support, while broader momentum remains constructive.

Momentum indicators are also supportive of further gains. The Relative Strength Index (RSI) is holding near 70, suggesting sustained buying interest, and the Momentum indicator continues to climb, reinforcing the bullish tone.

Despite the current pullback, the broader trend remains favorable for bulls unless the pair breaks decisively below the 1.1600 support zone. A move above 1.1800 would open the door for further upside toward the yearly high