The EUR/USD is trading in a downtrend on Monday. Uncertainty in France following Sunday’s parliamentary runoff election has put some selling pressure on the Euro (EUR). Also, later in the session, the Eurozone Sentix Investor Confidence for July will be released.

According to The Economist, exit polls indicated that the left-leaning New Popular Front (NFP), which is led by Jean-Luc Mélenchon, looks set to win a majority of seats in the second round of parliamentary elections held on Sunday. The NFP had secured nearly 174 seats.

However, this would fall far short of the 289 seats needed for control of the lower house. For its part, President Emmanuel Macron’s centrist Ensemble alliance secured 146 seats and Le Pen’s party was pushed to third place, winning some 142 seats. The euro has piqued the interest of some sellers after exit polls pointed to the final round of the French parliamentary elections taking place in a divided parliament.

The euro fell in the wake of early projections for the French legislative elections that the left-wing alliance would win a surprise victory, an outcome that traders largely dismissed and which has the power to reignite turmoil in the markets. The common currency eased 0.3% to around $1.0807 in early trading in Sydney.

Across the Atlantic, expectations for the US Federal Reserve’s rate cut probabilities following sluggish growth in US employment data could move the dollar (USD) lower and limit the pair’s decline. Data released by the U.S. Bureau of Labor Statistics indicated that U.S. Non-Farm Payrolls (NFP) increased by 206,000 in June, following a 218,000 increase in May. This figure turned out to be stronger than the estimate of 190,000. Also, the unemployment rate rose to 4.1% in June, up from 4% in May. Average hourly wages fell to 3.9% y-o-y in June from 4.1% previously, in line with market expectations. On Wednesday, the U.S. consumer price index (CPI) will be released, which is expected to fall to 3.1% y-o-y in June, down from 3.3% in May.

Also, on Tuesday of this week, Federal Reserve Chairman Jerome Powell will have to testify before the Senate Banking Committee as part of the Semi-Annual Monetary Policy report. Therefore, his comments related to monetary policy may influence the markets. On Thursday in the U.S., the June Consumer Price Index (CPI) will be released, and Friday will be the release of the preliminary estimate of the July Michigan Consumer Sentiment Index.

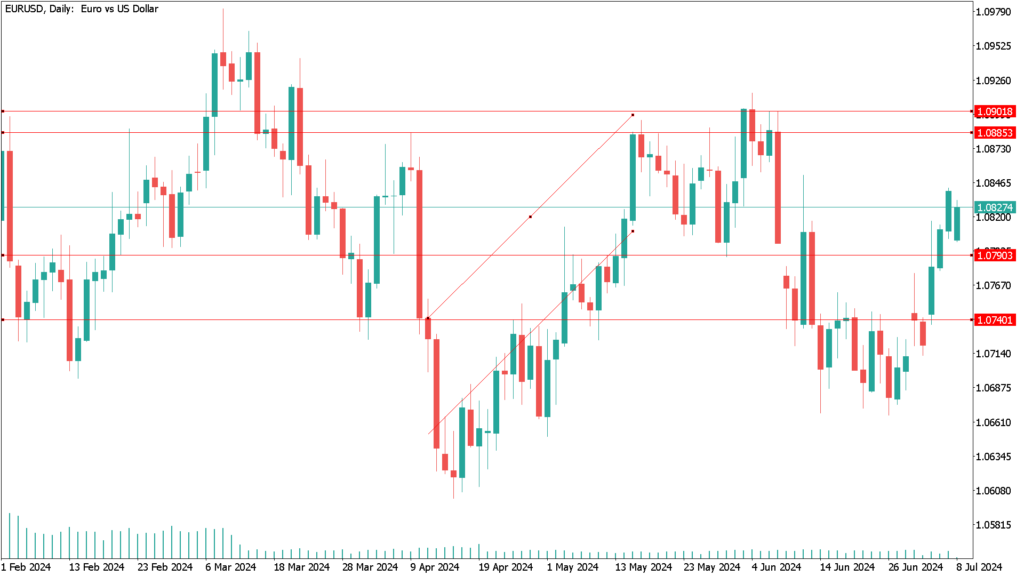

EUR/USD daily technical analysis for July 8th:

On the weekly chart, technical readings call into question the possibility of a stronger recovery. The EUR/USD is struggling around a flat 20 simple moving average (SMA), while a flat 100 SMA offers solid support around 1.0660. Technical indicators, meanwhile, have gained strength to the upside, but are within neutral levels.

The daily chart of the EUR/USD supports a bullish continuation, as the pair is trading clearly above all of its moving averages. The 100-day and 200-day simple moving averages (SMAs) converge aimlessly around 1.0790, and the 20-day SMA is also flat, albeit in the 1.0740 area. Technical indicators, on the other hand, remain at positive levels, although they have lost bullish strength.

The 1.0850 area offers resistance, although a break above it would expose the 1.0910 price zone. From this zone, the EUR/USD could extend its advance towards the 1.0960 level. The most immediate support is at 1.0790, and a break below would facilitate a decline towards the 1.0700 area.