EUR/USD is trading flat around the 1.1400 level during Monday’s Asian session, stabilizing after posting losses in the previous trading day. The pair remains under pressure as the U.S. dollar found support following robust U.S. jobs data released on Friday, which dampened expectations for near-term interest rate cuts by the Federal Reserve.

Strong U.S. Labor Data Supports the Dollar

According to the U.S. Bureau of Labor Statistics, Nonfarm Payrolls (NFP) increased by 139,000 in May, surpassing market expectations of 130,000 but falling short of April’s revised figure of 147,000 (originally reported as 177,000). Meanwhile, the Unemployment Rate held steady at 4.2%, and Average Hourly Earnings remained unchanged at 3.9%, with both metrics coming in stronger than anticipated.

Trade Talks Between the U.S. and China in Focus

Market participants are also closely watching the U.S.–China trade discussions scheduled to take place in London on Monday. U.S. Treasury Secretary Scott Bessent, along with two other Trump administration officials, is set to meet with Chinese counterparts. Tensions between the two nations remain elevated amid ongoing trade disputes, and any progress could have implications for global risk sentiment and currency flows.

ECB Officials Signal End of Easing Cycle

On the European side, comments from European Central Bank (ECB) officials offered limited support to the euro. ECB policymaker Yannis Stournaras stated that the eurozone economy has achieved a soft landing and that the current policy easing phase is nearly complete. However, he also warned that potential U.S. tariffs could present downside risks to growth.

ECB President Christine Lagarde echoed a similar tone, noting that monetary policy is “well-positioned” and nearing the end of its easing cycle. Still, she emphasized the unusually high level of uncertainty in the economic outlook.

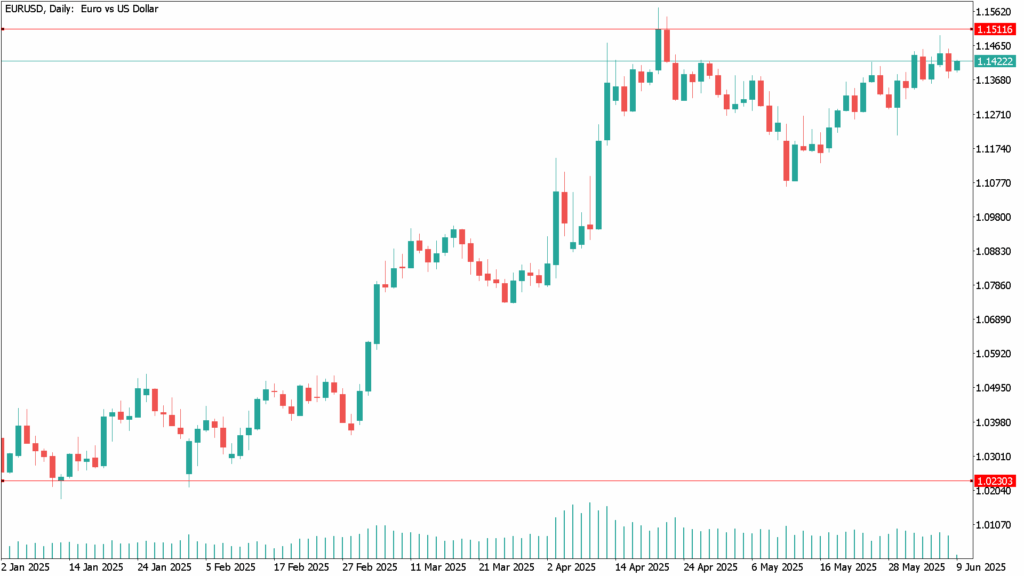

EUR/USD Daily Technical Analysis – June 9

The EUR/USD daily chart shows signs of slowing bullish momentum, though the bias remains cautiously tilted to the upside.

Technical indicators are gradually turning lower but remain above their midlines, suggesting that selling interest is still limited for now.

The 20-day Simple Moving Average (SMA) continues to slope gently upward, offering initial support near 1.1290.

The 100-day SMA remains above the 200-day SMA, reinforcing the broader bullish structure.