According to the results of the economic calendar, market analysts are divided over the number of rate cuts Federal Reserve officials will indicate for 2024. This division follows recent inflation figures that showed inflation remains elevated. In the big picture, policymakers may step back from their estimates of U.S. rate cuts this year, although it is uncertain whether two rate cuts will occur.

The FOMC, which has kept the benchmark interest rate at its highest level in two decades since July last year, was encouraged by the marked decline in inflation in the second half of 2023 to decide on a gradual rate cut this year. However, these plans were put on hold after failing to make progress in early 2024.

Overall, officials are hopeful of keeping the U.S. benchmark rate steady at a range of 5.25% to 5.5% for a seventh meeting in a row next week. Similarly, Chairman Jerome Powell and his colleagues will update their economic projections and discuss interest rates at the meeting scheduled for June 11-12, for the first time since mid-March. All in all, the fewer cuts indicate a possibly late start to the cuts. Ultimately, this could have an impact on the November presidential election, despite Fed officials’ uniform assurances that their decisions are based solely on economic terms.

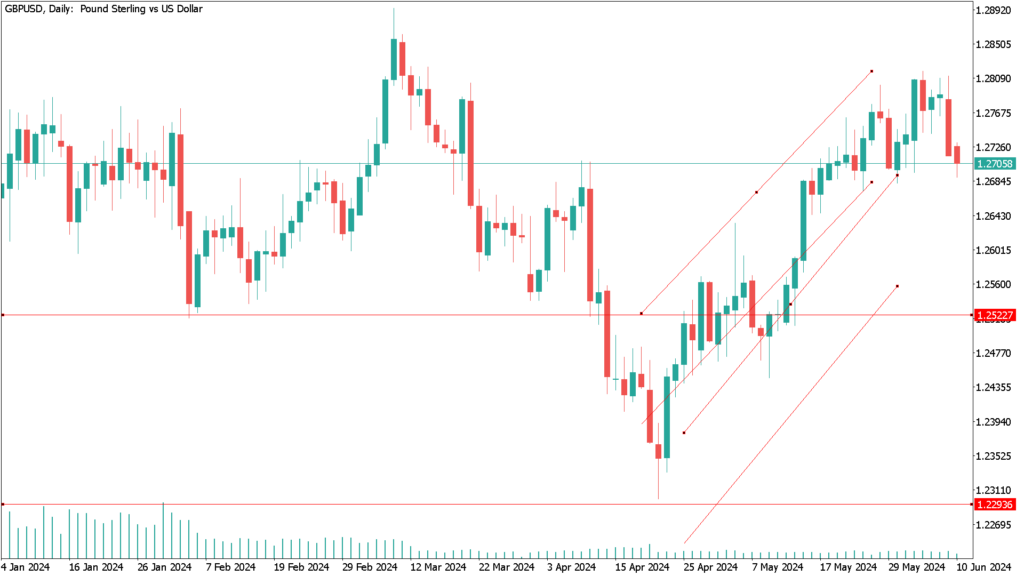

GBP/USD daily technical analysis for June 10th:

GBP/USD is expected to be under bearish pressure as markets and investors react to the US inflation figures along with policy decisions. Similarly, there will also be important economic releases in the UK. According to the daily chart, the 1.2775 resistance level continues to be crucial for the bulls to push the trend higher. Psychological resistance at 1.3000 will be key to confirming the strength of the uptrend. Conversely, the 1.2600 support level will remain the most important threat going forward.