The euro started the week on a softer note, although the outcome of the elections in France did not prove to be a hard blow, and the single currency may continue its recovery in the short term. The EUR/USD exchange rate softened on Monday after the results of the French elections and an unexpected result in favor of the coalition of both left-wing and far-left parties. Although it achieved a victory, it did not achieve sufficient numbers to form a majority in parliament.

In short, France has a “hung” National Assembly, which means that extremism on the left and right is avoided. Nevertheless, a political deadlock is looming on the horizon, which could be detrimental to a country that must reduce its debt levels in the coming years.

It should also be noted that the European Central Bank (ECB) is considering further rate hikes beyond the summer, and market expectations point to two more hikes between now and the end of the year.

This dollar rally triggered additional selling pressure on the greenback, driving it back to the 1.0800 area as market participants digested Chairman Jerome Powell’s first semi-annual testimony before Congress, where he reiterated that the Committee needs to see further progress in inflation towards the Fed’s 2% target before it begins to cut interest rates. However, Powell gave no indication of the eventual timing of a rate cut.

After Powell’s speech, the macroeconomic backdrop was particularly stable on both sides of the Atlantic.

Thursday will also bring important inflation-related data such as the CPI reading where core inflation is expected to come in below May’s 0.2%, a level that has only been recorded in January. On a year-over-year basis, it is expected to fall to 3.1% y-o-y. Clearly, these readings could point to the slowdown in U.S. inflation resuming its course after being truncated by accelerating prices in the first half of the year. This would raise the prospect of the Fed cutting interest rates in September, which could weigh on the dollar.

Looking ahead, the second testimony by Chairman Jerome Powell, speeches by Fed members and the release of US CPI inflation figures are expected to be the main drivers of the pair’s price action in the very near term.

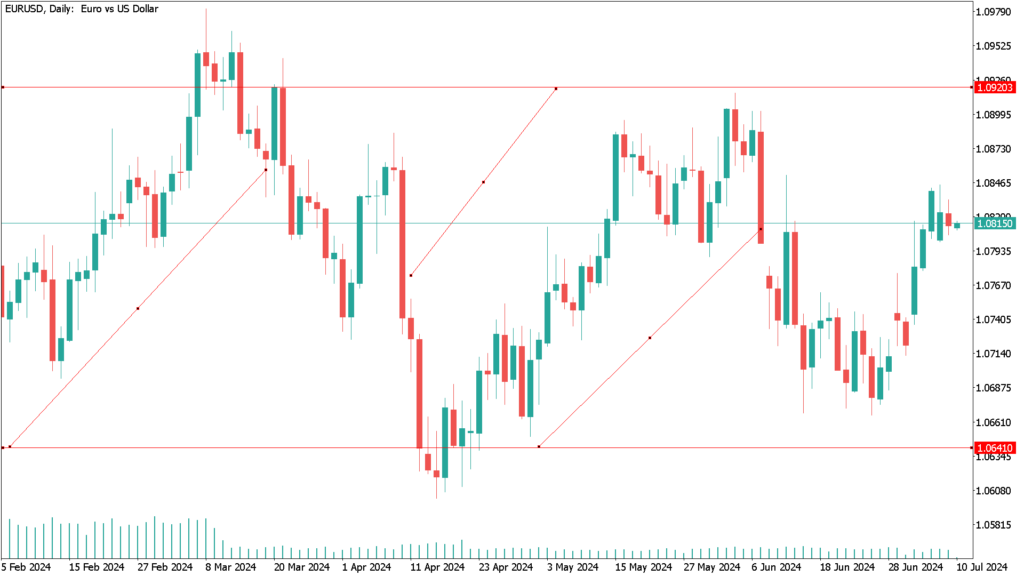

EUR/USD daily technical analysis for July 9th:

As for EUR/USD, it is expected to head towards the July high of 1.0845, then the weekly high of 1.0852 and the June high of 1.0916. If the pair breaks above this level, it could retarget the March high of 1.0981, then the weekly high of 1.0998 and the psychological barrier of 1.1000.

Should the bears regain control, spot could see the 200-day SMA at 1.0798 before its June low at 1.0666. This would be followed by the May low at 1.0649 and finally the 2024 low at 1.0601.

Looking at the big picture, more upside appears to be on the horizon if the critical 200-day SMA (1.0797) is routinely broken.