The EUR/USD pair remains stable during Tuesday’s session, trading around 1.1423, as markets await updates from U.S.–China trade discussions in London and the upcoming release of U.S. inflation data.

Markets Monitor U.S.–China Talks and Economic Data

Talks between Washington and Beijing entered their second day, with U.S. President Joe Biden calling them “productive.” However, investor sentiment remains cautious. Despite some optimism that common ground could be found on issues such as rare earths, chip exports, and student visas, the U.S. dollar has seen mild support.

On the data front, the U.S. NFIB Small Business Optimism Index climbed to 98.8 in May, marking a rebound after four consecutive monthly declines. This reflects improved sentiment among U.S. small businesses, which had been weighed down by trade uncertainties.

Improved Sentiment in Europe and ECB Commentary

In Europe, the Sentix Investor Confidence Index turned positive for the first time this year, signaling improved market sentiment. Several European Central Bank (ECB) officials offered insights:

- Yannis Stournaras highlighted the appeal of stable EU policy.

- Boris Vujčić noted the unclear impact of U.S. tariffs on inflation.

- Olli Rehn emphasized a data-dependent, meeting-by-meeting policy approach.

- François Villeroy de Galhau stated that the ECB has largely normalized policy.

- ECB President Christine Lagarde added that interest rates are nearing the end of the easing cycle—remarks that may lend further support to the euro.

Market Focus: U.S. CPI, ECB Guidance, and Wage Tracker

Investor attention now turns to the upcoming U.S. Consumer Price Index (CPI) release:

- Headline CPI is expected to rise to 2.5% year-over-year in May, up from 2.3%.

- Core CPI is forecast to tick up from 2.8% to 2.9%, indicating persistent inflationary pressures.

Despite improved eurozone sentiment, markets do not currently expect the ECB to cut rates at the July meeting.

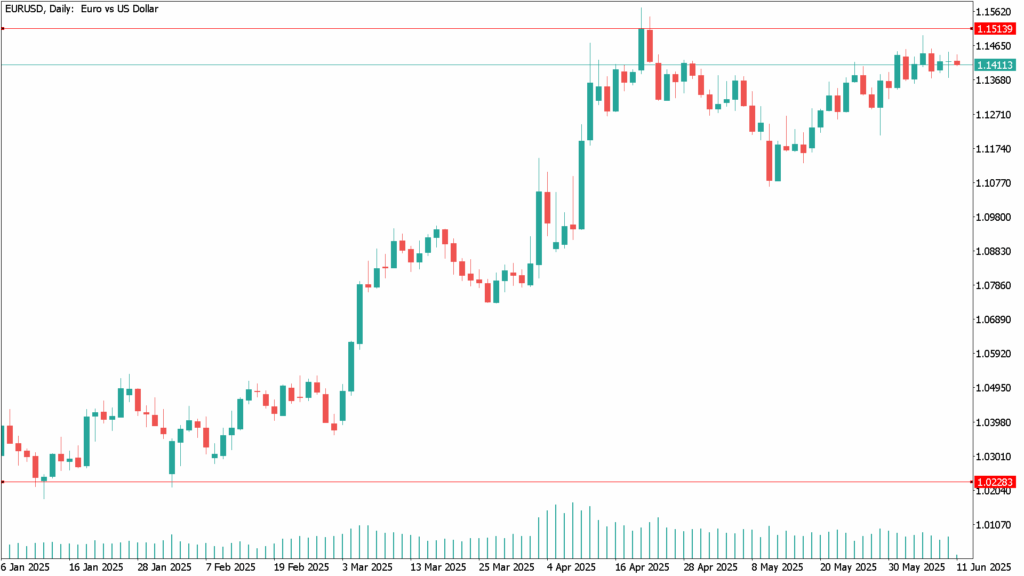

EUR/USD Daily Technical Analysis – June 11

EUR/USD continues to trend upward but has struggled to break through the 1.1500 barrier. The Relative Strength Index (RSI) suggests potential consolidation in the near term.

A drop below the 20-day Simple Moving Average (SMA) at 1.1331 would open the door to further downside toward 1.1300 and the 50-day SMA at 1.1281.