As this week begins, the EUR/USD is moving within a very tight range in a quiet environment, with little economic data scheduled for today and anticipation building for the US inflation figures due later this week. This is likely to elicit a significant and direct response concerning the future of monetary policy by the Federal Reserve.

This will probably provoke an important and direct response regarding the Federal Reserve’s future monetary policy.

Overall, the release of the US consumer price index for April, due next Wednesday, represents perhaps the biggest test since the recent rate hike. Earlier this month, Fed Chairman Jerome Powell alleviated concerns about further rate increases. This concern gained momentum after the Labor Department reported slowing job growth, which triggered a significant drop in yields.

This development has increased the risks associated with the upcoming inflation data, which could either exacerbate or alleviate these concerns. Earlier this year, US CPI reports prompted a major sell-off in the bond market, as readings higher than expected fueled concerns that the Fed’s progress against inflation had stalled. The most recent report, on April 10, drove 10-year Treasury yields up by about 18 basis points—the largest one-day movement triggered by CPI data since 2002.

Until this month, the data largely indicated economic strength, causing traders to reconsider earlier predictions of multiple Federal Reserve rate cuts this year. So far, this readjustment has led to further investment losses and reduced confidence in the market’s future direction.

According to the economic calendar, analysts expect the upcoming CPI data to show a slowdown in inflation rates. The core index, which excludes volatile food and energy costs and is considered a reliable measure of underlying inflation pressures, is expected to rise by 0.3% in April, down from 0.4% in March, according to market analysts.

The overall index is forecast to have risen by 3.4 percent over the past year, compared to a 3.5 percent increase in March. Overall, this is still well above the Federal Reserve’s target rate of 2 percent. Recently, several US central bank officials have stated that interest rates are likely to remain high for an extended period. Furthermore, Bank Governor Michelle Bowman has noted that the current pace of inflation suggests it may not be appropriate for policymakers to cut rates in 2024.

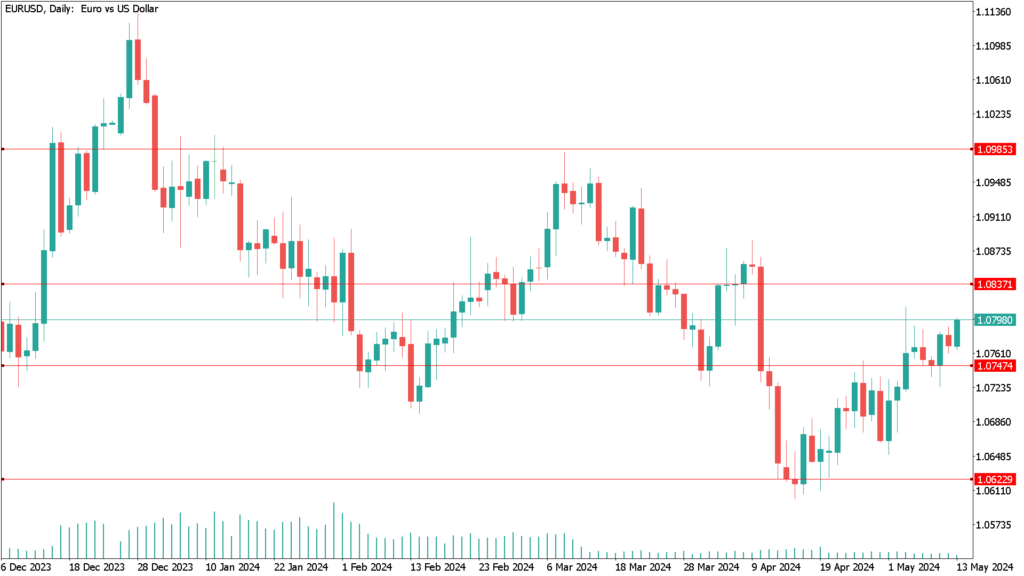

EUR/USD daily technical analysis 13 May:

According to the daily chart, the EUR/USD pair still lacks the necessary momentum to complete an upward bounce. It appears that the pair will not achieve this without reaching the resistance levels of 1.0830 and 1.100, respectively.

On the other hand, a return to the support levels around 1.0700 and 1.0620 could jeopardize any bullish attempts. Such a move might also confirm whether bears will push the price down towards the psychological support level of 1.0500.