The EUR/USD is trading near its highest level in over a month, ahead of the release of crucial US inflation data that is expected to significantly impact the Fed’s monetary policy outlook.

As currency markets await key data from the world’s leading economy, which will impact the dollar and overall market sentiment, earlier strong wage growth in the euro zone is unlikely to ease European Central Bank officials’ concerns as they assess the potential for rate cuts.

Economic data from the bloc’s largest economies show that wage increases did not significantly slow in the first quarter of the year. There is a danger that companies will pass on cost increases to consumers, which could sustain inflation above 2% for an extended period.

Germany has been a major factor, as past agreements, including some with one-off payments, have led to sharp wage increases. Monetary policymakers are unlikely to be reassured about moderating rates in the rest of the region.

Consequently, while the initial June cut in the deposit rate is almost certain to be maintained, expectations for another swift cut in the following month are diminishing. Conversely, the above-expected growth in the 20-nation bloc supports a cautious approach, even though inflation is near the target.

For the ECB, the challenge lies in ensuring that negotiations proceed differently than in other parts of the continent. Meanwhile, in Belgium, many contracts are closely linked to inflation. In contrast, both Italian and German workers often must wait for new bargaining rounds that set compensation over the years.

In France, bargaining is much more relaxed, with wages in several sectors agreed upon annually. Similarly, policymakers emphasize that corporations should absorb some of the higher labor costs, especially since profit margins have increased recently.

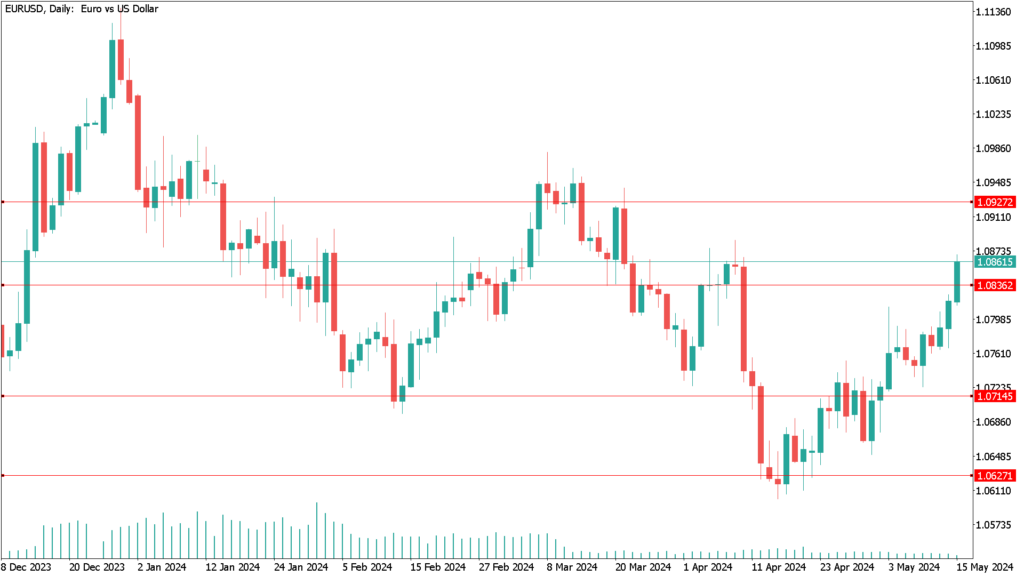

EUR/USD daily technical analysis 15th May:

According to the daily chart, the EUR/USD is trending upward within a specific range. For a stronger upward trend, the EUR/USD must reach the resistance levels of 1.0830 followed by the psychological mark of 1.1000.

Otherwise, within the same timeframe, a retreat to the 1.0720 support level could significantly motivate bears to target the 1.0600 psychological support level.