There is a lot of optimism in the market regarding inflation. While experts expect inflation to decrease significantly by 2024, there are doubts about achieving the Fed’s target of 2%.

In the coming months, especially in March, if inflation shows signs of weakness and decline, the Fed may cut interest rates. All remains to be seen in the coming days.

We should also keep an eye on the Consumer Price Index data as it will tell us whether inflation is really coming down or on the contrary is on the rise and more measures should be taken to tighten the economy to cope with inflation.

As a recommendation for those interested in trading this currency pair, it is essential to pay attention to production and consumption data to get a possible idea of how inflation could be and to know when to sell or buy positions in the foreign exchange market, where USD/EUR is the most potent pair to trade today. The dollar’s strength will continue to significantly influence the USD/EUR pair.

In-depth analysis for today:

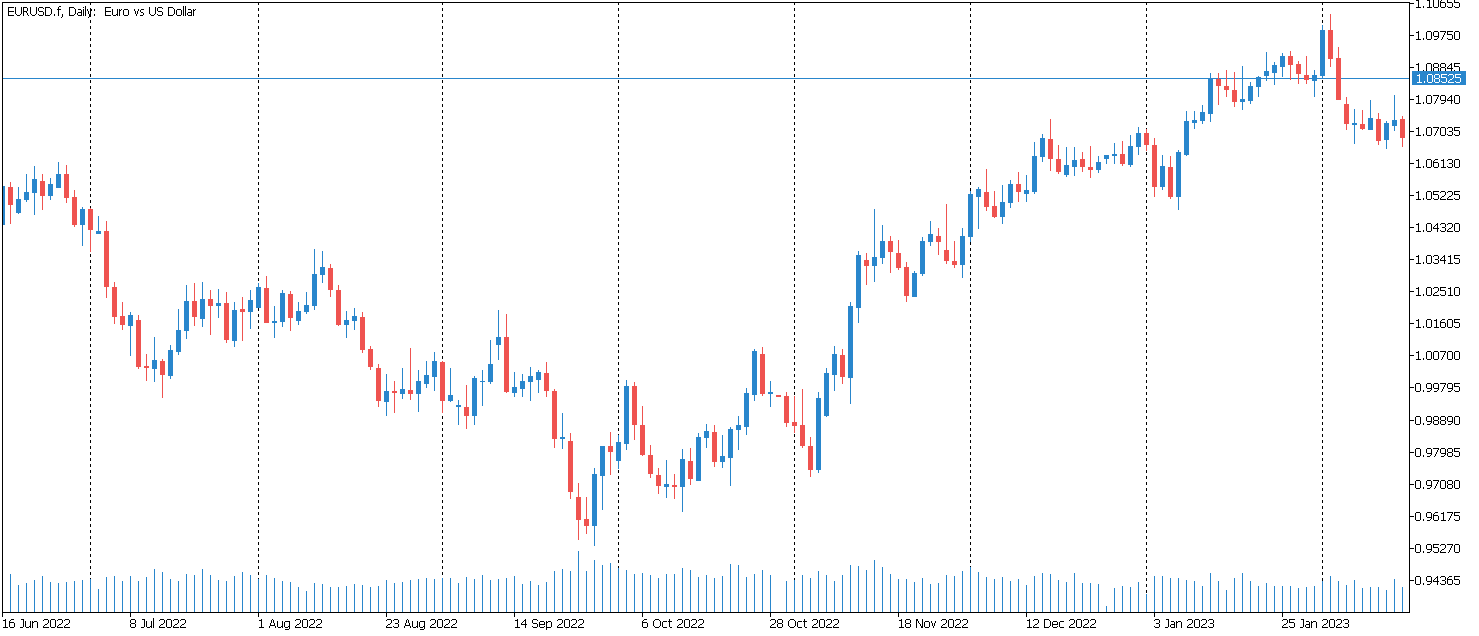

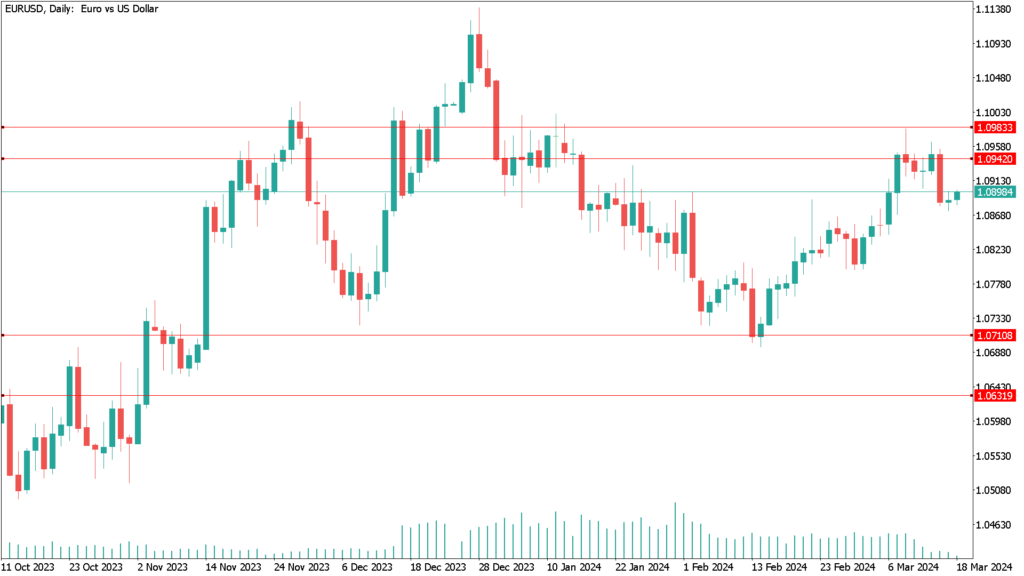

According to the chart, the position of the USD/EUR pair is neutral, although it is trying to rebound with an upward trend, surpassing the possible resistance of 1.1000 and thus being able to take off. Resistance levels can be found between 1.1020 and 1.1000; the resistance will significantly help in case of a trend.

As mentioned above, inflation plays an important role, and this currency pair can reach the levels mentioned if the inflation data does not meet expectations. On the other hand, if the figures are much better than expected, a downward trend could occur and find support at 1.0880. Close attention to the currency pair’s movement is necessary to determine potential losses or gains, depending on your trading positions.