EUR/USD extends its decline for a second straight session, trading around 1.1540 during Monday’s trading hours. The pair remains under pressure as the US Dollar strengthens on the back of safe-haven demand, fueled by escalating geopolitical tensions in the Middle East.

On Friday, Israel launched attacks on Iranian nuclear facilities and missile sites. In response, Iran struck back late Sunday, with explosions reported in Haifa. Despite growing international calls for restraint, Israel has continued its military operations. According to Iranian media outlet Mehr News, Iran has now entered the fourth phase of its military response, with officials warning of firm retaliation against any further Israeli action.

Adding to the dollar’s momentum, the University of Michigan’s Consumer Sentiment Index rose sharply to 60.5 in June, up from 52.2 and well above expectations of 53.5. The strong reading supports the case for policy stability, and the Federal Reserve is widely expected to hold rates between 4.25% and 4.50% at Wednesday’s meeting. Nonetheless, markets are still pricing in a 25 basis point rate cut by September.

The euro is finding some underlying support from speculation that the European Central Bank (ECB) may pause its easing cycle to assess the impact of new US tariffs, potentially limiting further downside in the pair.

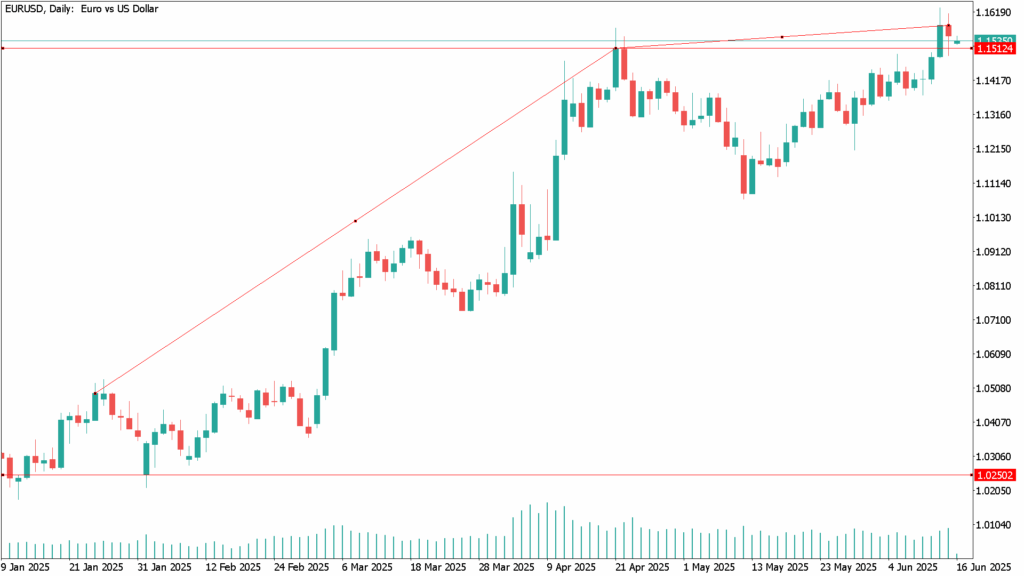

EUR/USD Daily Technical Analysis – June 16

While EUR/USD is undergoing a corrective pullback, the broader bullish trend remains intact. Technical indicators have edged lower but still hold above their midlines, indicating a soft tone without a clear bearish reversal. The pair remains above all key bullish moving averages, with the 20-day SMA offering near-term support around 1.1380.

Immediate support lies at 1.1470, followed by 1.1380. A break below could expose the 1.1300 level. On the upside, resistance is seen at 1.1630, ahead of the psychological 1.1700 threshold.