The EUR/USD gyrated around 1.0900 on Tuesday as markets struggled with hopes of a rate cut in September, hopes that were left on the high side even more so after US retail sales figures appeared to soften more than expected in June. Markets have dismissed the start of a Fed rate cutting cycle for September, with about three rate cuts of around a quarter point estimated for the year.

In Europe, the European Central Bank is set to announce its interest rate decision on Thursday. Interest rates are expected to remain unchanged, although markets will want to know if the Bank will cut rates again in September. If the ECB gives such a signal, the euro could come under pressure.

The ECB is expected to maintain a data-dependent policy stance, i.e., as accommodative as possible.

In the US, during June, retail sales were flat, meeting estimates and falling from last month’s revised 0.3%. This decline in retail sales raised market expectations of a rate cut at the next Federal Open Market Committee meeting on September 18. The weakness in US sales, coupled with the recent easing of the consumer price index (CPI) data in the prior week, has raised the possibility of a rate cut in September. The previous week’s weaker US CPI inflation data helped to bolster confidence.

According to CME’s FedWatch tool, markets now see a near 100% chance of a rate cut by at least a quarter point in September, with the possibility of up to three cuts between now and 2024.

Overall, the rate is expected to hold on Thursday as policymakers wait to see if data improves after an initial quarter point cut in June.

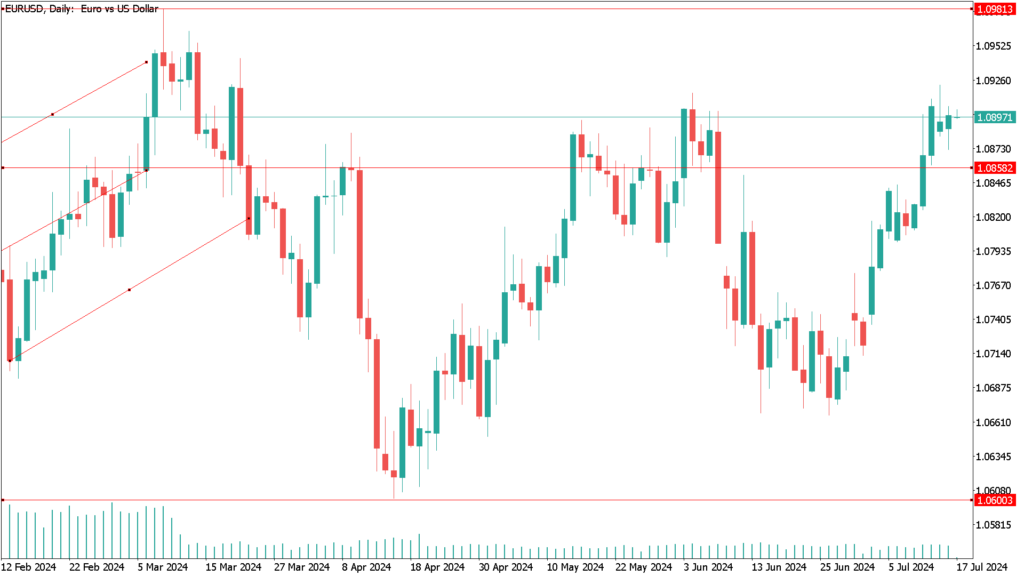

EUR/USD daily technical analysis for July 17th

The EUR/USD failed to make a strong break above the 1.0900 level last week, and intraday bidding is choppy just south of the fundamental technical barrier as markets wait for significant momentum to build in either direction. The Fibonacci level is close to the four-month high set at 1.0922 the previous Friday, and the key strategy for buyers will be to get EUR/USD ahead of the 200-day Exponential Moving Average (EMA) at 1.0789.

The Fibonacci trade is stuck at the upper edge of a rough descending channel, and prolonged weakness could drag the bulls back to the lower edge, with the last swing low priced just north of 1.0650.