The EUR/USD currency pair declined sharply by more than 0.60%, currently trading at 1.1484 after retreating from daily highs of 1.1579. The US Dollar’s strength stems from its appeal as a safe-haven asset during periods of geopolitical uncertainty, particularly as tensions in the Middle East between Israel and Iran continue to escalate.

Market Drivers

The intensifying conflict in the Middle East has prompted investors to seek refuge in the US Dollar. President Trump’s recent social media statement demanding Iran’s “unconditional surrender” further bolstered the Greenback, which reached a four-day high. The US Dollar Index (DXY)—which tracks the dollar’s performance against six major currencies—surged over 0.67% to 98.79.

According to CNN reports, the Trump administration is reconsidering diplomatic options in the region, while also evaluating potential military strikes on Iranian nuclear facilities.

From an economic perspective, recent US data remains mixed. Retail Sales have contracted for two consecutive months, and Industrial Production also declined, according to the Federal Reserve. Despite these figures, the dollar’s current strength appears largely driven by geopolitical risk rather than economic fundamentals.

In the Eurozone, German ZEW Economic Sentiment data came in above expectations, offering some support for the Euro. However, recent remarks from European Central Bank (ECB) officials have taken on a more neutral tone, with policymakers opting for a cautious, wait-and-see stance.

Market Outlook

While the EUR/USD pair has pulled back, its broader upward trend may remain intact. Key market-moving events this week include the Federal Reserve’s monetary policy meeting on Wednesday, the release of the Summary of Economic Projections (SEP), and Chairman Jerome Powell’s press conference—all of which could significantly affect the pair’s direction.

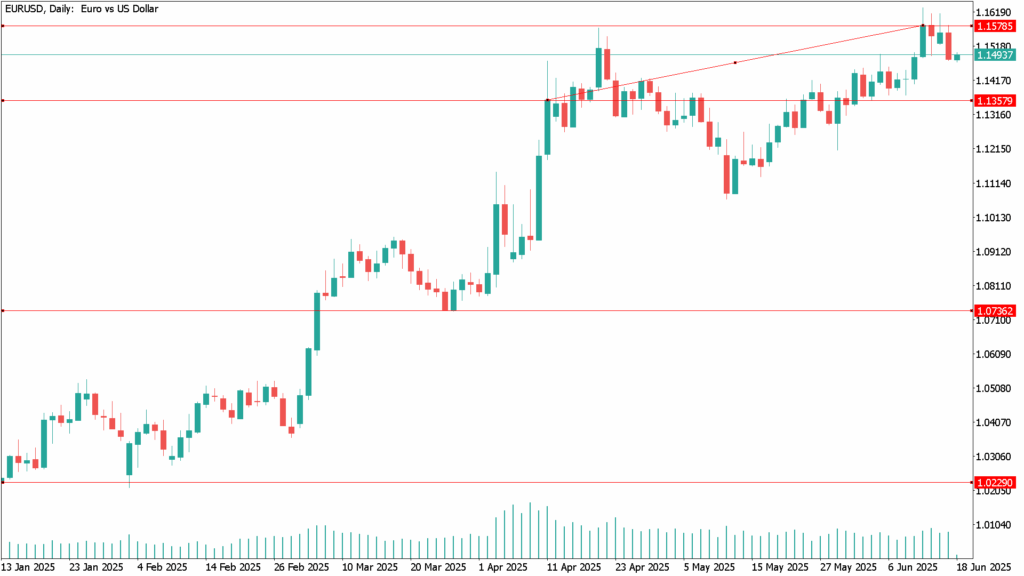

EUR/USD Daily Technical Analysis – June 18

The EUR/USD has encountered a temporary pause in its recent upward momentum, with prices dropping below the 1.1500 psychological level. The Relative Strength Index (RSI) signals weakening bullish momentum, suggesting that buyers are pausing after the recent rally.

Support and Resistance Levels

- Immediate Support: 1.1450, followed by the 20-day Simple Moving Average (SMA) at 1.1411

- Key Support: 1.1400, if the moving average is breached

- Resistance Targets: 1.1500 (immediate), 1.1600, and the June 16 high of 1.1614

- Ultimate Target: Yearly peak of 1.1631

The current technical setup suggests that while the pair may experience additional short-term weakness, the overall bullish structure remains intact. A recovery above 1.1500 would likely trigger renewed buying interest toward higher resistance levels.remains intact. A recovery above 1.1500 would likely trigger renewed buying interest toward higher resistance levels.