EUR/USD rebounded from previous session losses on Monday, trading near 1.1190 as the U.S. dollar came under pressure following Moody’s downgrade of the U.S. credit rating from Aaa to Aa1. The agency cited growing fiscal concerns, including ballooning debt and increasing interest payment burdens.

This downgrade follows earlier moves by Fitch (2023) and Standard & Poor’s (2011). Moody’s now projects U.S. federal debt to surge to 134% of GDP by 2035, up from 98% in 2023, while the federal deficit could widen to nearly 9% of GDP—driven by higher debt servicing costs, entitlement spending, and falling tax revenues.

Despite these warnings, losses in the greenback may be limited due to improving global trade sentiment. A preliminary U.S.-China agreement includes major tariff reductions: Washington plans to slash duties on Chinese goods from 145% to 30%, while Beijing will cut tariffs on U.S. imports from 125% to 10%. Market optimism is also supported by renewed hopes for a U.S.-Iran nuclear deal and upcoming U.S.-Russia talks aimed at easing tensions in Ukraine.

Euro Outlook Softens on ECB Rate Cut Expectations

The euro, meanwhile, faces headwinds amid rising expectations that the European Central Bank (ECB) could cut rates at its next policy meeting. Traders are growing increasingly confident that Eurozone inflation is nearing the ECB’s 2% target, while the region’s weak economic outlook supports a more dovish stance.

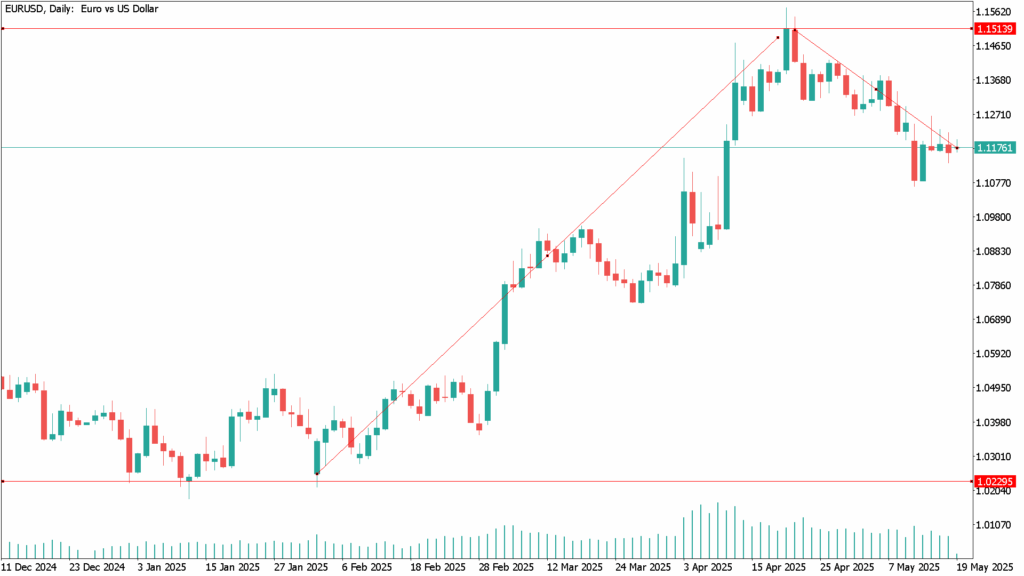

EUR/USD Daily Technical Analysis for May 19th

EUR/USD has remained trapped in a narrow range over the past three sessions, with intraday gains quickly fading. The 20-day SMA is turning lower and offers resistance around 1.1300, while the 100- and 200-day SMAs trend upwards but remain well below current levels.

Technical indicators remain in negative territory with neutral-to-bearish momentum, signaling weak buying interest. A break above 1.1300 could lead to further gains toward 1.1380 and 1.1460, with the yearly high at 1.1573 as a potential long-term target. On the downside, key support lies at 1.1160; a drop below this level would open the path toward the May low at 1.1064, followed by the key psychological level of 1.1000.