At the beginning of the week, the EUR/USD was able to stabilize near $1.07, remaining at its lowest levels for the past seven weeks. This follows a 0.8% decline in the previous week, which represents the biggest loss since April.

In a general overview, market participants are keeping an eye on the political turmoil in France in expectation of any news.

Legislative elections are scheduled for June 30 and July 7, with Le Pen’s National Rally party leading in the polls. Recently, the party has made policy proposals such as cutting sales taxes along with lowering the retirement age, and political uncertainty has led to a sell-off in bonds and an increase in risk premiums in France.

In this regard, European Central Bank officials have said that they are not currently considering emergency purchases of French bonds. On the monetary policy front, the European Central Bank in recent weeks implemented its first interest rate cut in five years, although it is adopting a cautious approach when it comes to further cuts.

The EUR/USD is likely to remain under pressure in the coming days amid the political backdrop in France. The exchange rate lost 0.88% in the previous week, which led to further technical deterioration. As a result, further weakness is expected in the coming days.

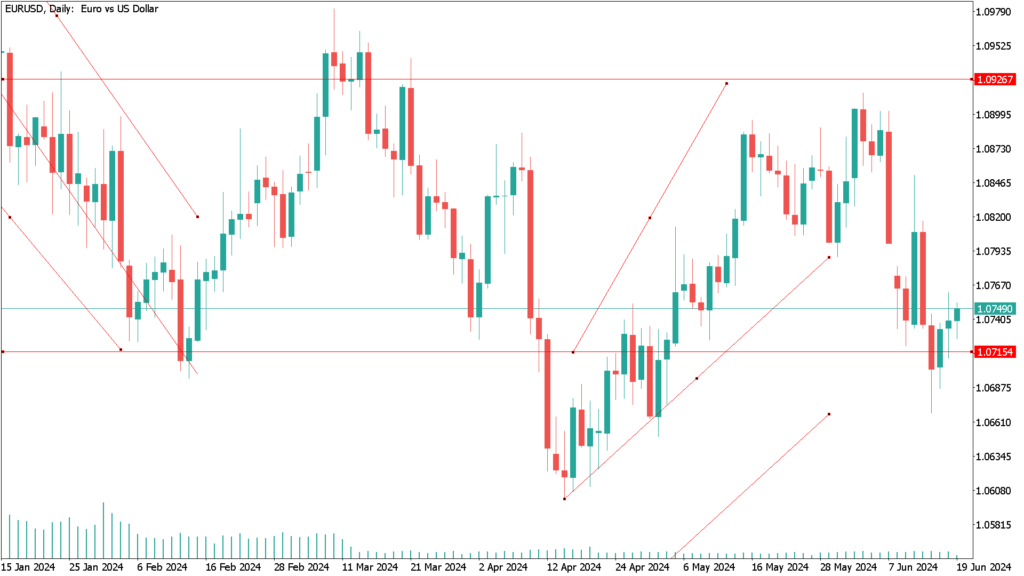

EUR/USD daily technical analysis for June 19th:

The next bearish target is the 1.0668 support level, which is the 78.6% Fibonacci level of the April-May rally. There was a strong rejection of this level on Friday, which suggests that this is where the support is located. Technically, the Relative Strength Index (RSI) in the lower panel of the chart is at 38 and pointing down, ratifying that the short-term momentum is negative. The exchange rate is below its 200-day moving average, which we take as a key sign that the overall setup is now negative. While rallies are to be expected from time to time, they will eventually give way to a more pronounced downtrend.

Finally, the next two to four weeks may see a test of the April lows at the 1.06 support level.

Overall, France will be the focus for the euro this week, and worsening confidence will lead to further weakness. According to Christina Clifton, strategist at Commonwealth Bank, “EUR/USD could continue to move lower due to the ongoing political problems in France.”

All in all, we note that the week has started relatively quiet, implying that the events of the weekend have been muted. We ponder whether much of the bad news is already hanging over the euro, raising the chances of a recovery. “The market reaction has been logical, contained and there are no signs of panic. Investors are reconsidering France’s risk premium, but this is normal,” the analysts stress. They add that the parliamentary majority of the National Rally, the right-wing populist party led by Marine Le Pen, will not be a “confidence barrier” for investors. Markets therefore expect President Emmanuel Macron’s centrist party to lose the legislative vote, meaning it will have to accommodate a far-left or far-right prime minister. Market fears are that this could further worsen France’s debt situation, which is already at worrying levels.

The chart illustrates that the spread between French and German 10-year bond yields has widened as investors sell French bonds in reaction to concerns about the country’s debt trajectory in the face of political uncertainty. Moreover, the euro-dollar exchange rate is under pressure as the spread widens, accentuating the link between the currency and political concerns.

The European Commission says France’s 2024 budget presents a risk of non-compliance with the bloc’s fiscal rules. Obviously, the EU will reinstate this year the debt and deficit rules that were suspended during the pandemic. Recently, the Commission asked the French government to take measures to comply with EU fiscal rules.

Macron’s government has already been struggling to balance the country’s fiscal record with voter demands for more spending. According to forecasts published at the end of 2023, the Commission estimates that debt as a percentage of economic output will rise to 110% of GDP by 2025.

Political uncertainty in France is likely to continue for at least several weeks, putting some downward pressure on the euro. In addition, any advance in the euro against the US dollar EUR/USD is susceptible to a sharp decline.

On Thursday, the US economic calendar will feature weekly data on initial jobless claims and May building permits. Market participants will also continue to watch for announcements from central bank policymakers in the second half of the week.