The EUR/USD pair retreats to around 1.1480 in early Asian trading on Monday, as the U.S. dollar gains traction amid escalating geopolitical tensions. President Donald Trump’s announcement that the U.S. has joined Israel in military action against Iran has intensified the conflict, pushing investors toward safe-haven assets like the greenback.

Over the weekend, U.S. forces reportedly struck Iranian nuclear sites in Fordo, Natanz, and Isfahan. Trump claimed the facilities were “totally obliterated” and warned of more severe action unless Iran seeks peace. The geopolitical flare-up has weighed on the euro while bolstering the dollar’s appeal.

In Europe, the ECB cut interest rates for the eighth time this year to support the struggling eurozone economy but signaled a likely pause in July. ECB President Christine Lagarde emphasized that the bank is now well-positioned to navigate current uncertainties, adding a hawkish tilt that may help cushion the euro’s downside.

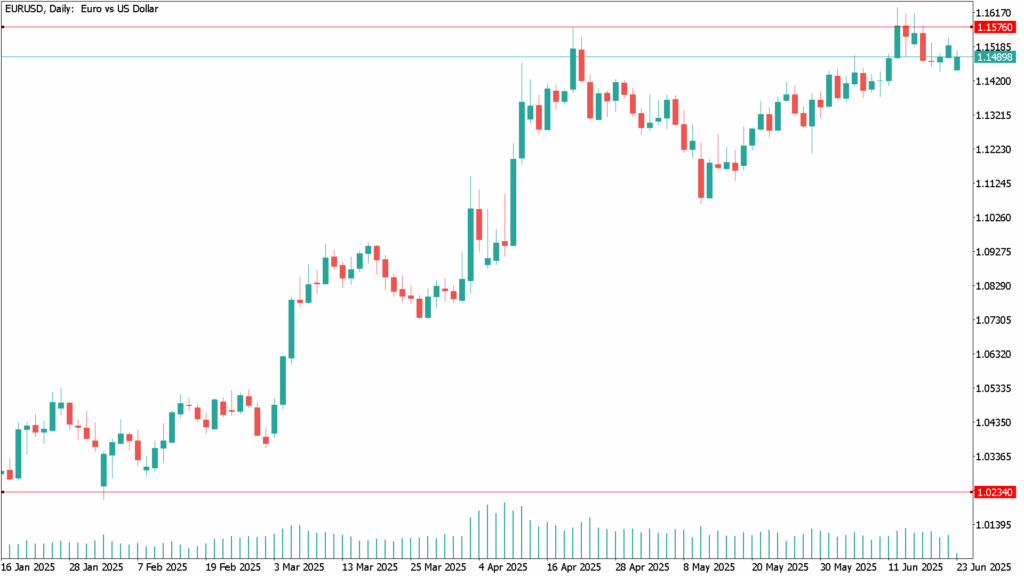

EUR/USD Daily Technical Analysis – June 23

Technicals suggest a bullish bias despite the recent pullback. Indicators remain in positive territory, with the 20-day SMA offering support near 1.1435. The 100-day SMA also continues to rise above the 200-day SMA, reinforcing upward momentum. A break below 1.1470 could open the door to 1.1300, while a move above 1.1560 would pave the way toward retesting the 2025 high at 1.1631 and possibly targeting 1.1700.