The EUR/USD is expected to show strength this week, though it is likely to stay above the psychological support level of 1.05.

According to several forex analysts, the euro is under pressure against the dollar as markets anticipate the European Central Bank independently proceeding with rate cuts in June, without mirroring similar actions by the Federal Reserve.

Overall, the impact of interest rates is critical; thus, weak U.S. economic data is considered essential to convince markets of the likelihood of multiple Fed rate cuts this year.

However, the recent rally in the dollar, coupled with overbought conditions, could trigger a retracement of these gains, potentially strengthening the euro. However, this strength may be too short-lived as there are indications that a weakening of the exchange rate could occur in the coming weeks.

There is a possibility that EUR/USD could reach lows not seen since November 2022, and these trends could necessitate further pricing of Fed cuts versus more ECB cuts, which are most likely already discounted. Additionally, the EUR could regain ground against the USD if US economic growth figures due on Thursday come in below expectations of 2.3% annual growth in the first quarter. A positive result alone would merely affirm the USD’s strength; however, given recent gains, the market might react more significantly to a figure that misses estimates.

Conversely, based on the economic calendar results, it is possible that the U.S. GDP reading will have a larger near-term impact on the currency market. Meanwhile, the most important event of the week for the dollar is Friday’s PCE inflation reading.

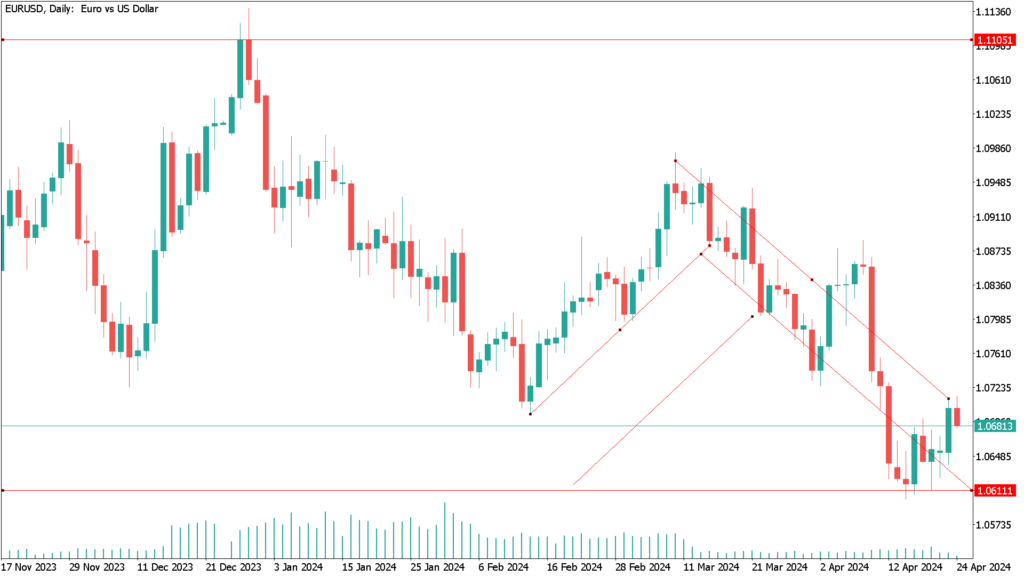

Daily technical Analysis EUR/USD April 24th

Now, U.S. CPI numbers could impact the market with any deviation from the expected 0.3% monthly growth. Again, we expect the main reaction in the FX market to follow a drop in the numbers, as this will provide markets with a hedge on the gains from the recent strength in the US dollar.

Likewise, it is expected that in the event of gains by the Eurozone it will consolidate and may move beyond psychological resistance.

The 50-day EMA above would be a target if the 1.07 level is breached, but could also end up being a major barrier. Should it fall below the 1.06 level, the target would be the 1.05 level below. This market will likely continue to see significant fluctuations more than anything else. Now, if you are a short-term trader, you may find some value in this type of behavior.