The euro (EUR) fell sharply against the dollar (USD) last week on growing confidence that the European Central Bank (ECB) will cut interest rates by June, while the market expects the Federal Reserve (Fed) to cut rates only in July. This difference in timing of rate cut expectations could potentially strengthen the dollar until the end of this month.

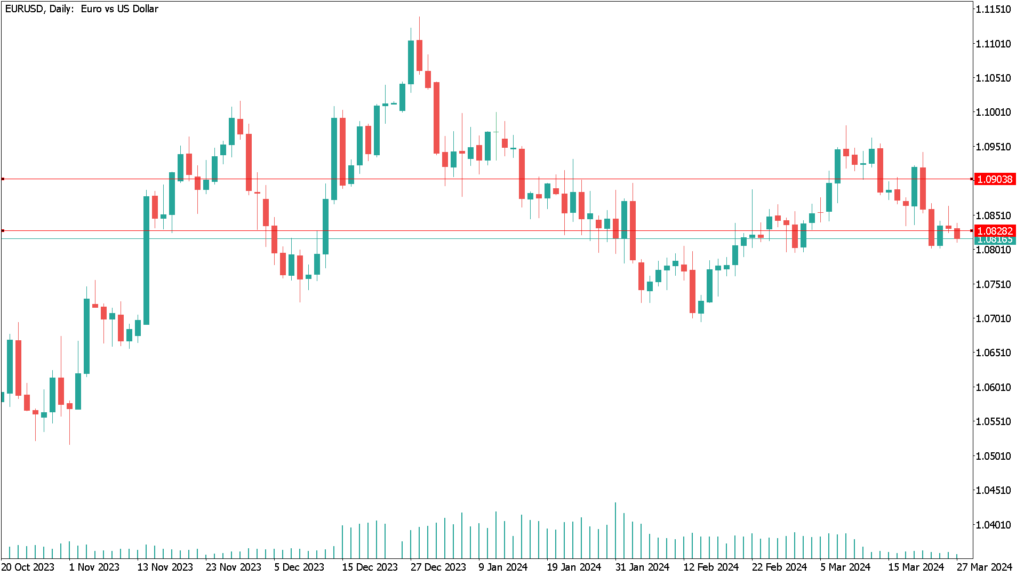

Technically speaking, the EUR/USD currency pair in recent days has traded below the 50, 100 and 200-day moving averages, a clear sign that the trend may be changing from positive to negative.

Looking at the Eurozone calendar, today’s Spanish inflation data will be released. Spanish inflation often precedes Eurozone inflation due to its quick effects, potentially signaling whether the inflation trend in the Eurozone remains intact.

Eurozone inflation figures were due to be released this week but due to the Easter holidays, they will be released early next week. The inflation data will be closely watched by Forex investors, as it could inform the outcome of the ECB’s monetary policy meeting on April 11. Therefore, any surprises to the downside could reinforce market estimates of where the Bank will go next and when it will start lowering rates. Additionally, a possible rate cut could happen soon, most likely at the June meeting. On the other hand, the build-up of market expectations for an ECB rate cut could increase, which would exacerbate the EUR/USD’s downside.

On the US side, key inflation data will be released on Friday this week. The Federal Reserve analyzes the Personal Consumption Expenditures (PCE) index to get information about inflationary prices experienced by consumers in the US. This data will be released on Friday, but keep in mind that most markets will be closed for the Easter holiday, with the headline rate expected to be 0.4% month-over-month for February.

Any upside surprise to this figure increases estimates that the Fed does not need to cut rates, which could serve as support for the dollar’s recent rally.

Daily technical analysis EUR/USD March 27th

The EUR/USD price created higher lows connected to the downtrend line, which remained untouchable throughout the month. The Fibonacci tool indicates possible levels for sellers at 1.0857 and 1.0873. the Fibonacci tool shows possible levels that sellers can access. If the trend reverses upwards, the nearby levels to watch are 1.0800 and the psychological mark at 1.0900.

There may not be much change in the pair trends and behaviors as it seems to be a quiet week for EUR/USD due to the holidays.