The EUR/USD was unable to break or at least challenge the 1.09 level during the previous week, instead dropping to the 1.0850 level within tight ranges. Also, this week will be crucial as Friday brings important US inflation data.

Recently, the minutes of the Federal Reserve’s May meeting indicated that inflation had not retreated further in recent months. In line with the economic calendar results, US business confidence PMI data also came in stronger than expected, with the services index rising to its highest level in a year at 54.8 from 51.3.

It should also be noted that interest rates provide room for USD gains. However, US bond yields began to fall as inflation started its decline in April and is likely to continue gradually declining. Additionally, current geopolitical risks may stimulate cyclical safe-haven demand for the USD.

For their part, European Central Bank policy makers are reluctant to make any more promises regarding further rate cuts, as they seem to be concerned that aggressive policy easing could reignite inflation pressures again.

In this context, traders have reduced their expectations from three rate cuts to two this year, as recent indicators, such as negotiated wage rates in the first quarter, suggest continued price pressures.

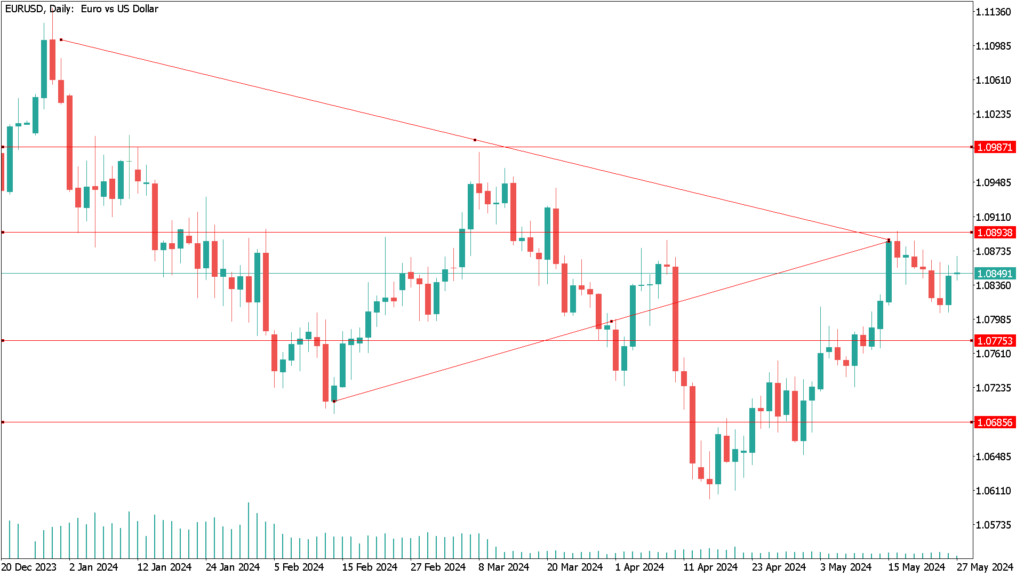

EUR/USD daily technical analysis 27th May:

EUR/USD consolidates around 1.0850 ahead of crucial Eurozone and US inflation data. EUR/USD shows further strength as it solidly holds the breakout of the symmetrical triangle chart pattern that has formed on the daily timeframe.

In the short term, the EUR/USD remains firm, as it trades above all short to long term EMAs.

The 14-period RSI has pulled back to the 40.00-60.00 area, suggesting that the bullish momentum has fizzled out for the time being.

If the pair continues to move higher, it is likely to regain the two-month high around 1.0900. A break above this level would put the pair on track towards the March 21 high around 1.0950 and the psychological resistance at 1.1000. Conversely, a bearish move below the 200-day EMA at 1.0800 would send the pair lower.