EUR/USD continued its decline for a second straight session on Monday, slipping toward the 1.1360 area during early trading hours. The pair remains under pressure as the U.S. Dollar gains traction, bolstered by signs of easing tensions between the United States and China.

On Friday, reports emerged that China had exempted certain U.S. imports from its 125% tariffs, sparking optimism that the prolonged trade dispute between the world’s two largest economies could be nearing a resolution.

Adding to the positive sentiment, U.S. Agriculture Secretary Brooke Rollins stated on Sunday that the Trump administration is engaged in daily discussions with China over tariff issues. Speaking to Reuters, Rollins highlighted that negotiations are ongoing and hinted that trade deals with other countries are also close to completion.

However, not all signals point to immediate progress. Reuters cited a Chinese embassy spokesperson on Friday, who firmly denied the existence of any active negotiations, asserting that “China and the U.S. are not having any consultation or negotiation on tariffs.” The spokesperson called on Washington to “stop creating confusion.” Furthermore, a Beijing official reiterated on Thursday that no “economic and trade negotiations” are currently underway, stressing that the U.S. must first “completely cancel all unilateral tariff measures” before talks can resume.

Meanwhile, expectations for further easing by the European Central Bank (ECB) are building, driven by concerns that inflation in the eurozone could remain below the ECB’s 2% target. Last Thursday, ECB policymaker and Finnish central bank governor Olli Rehn warned of potential downside risks to inflation, suggesting that medium-term projections could fall short of the target under current conditions.

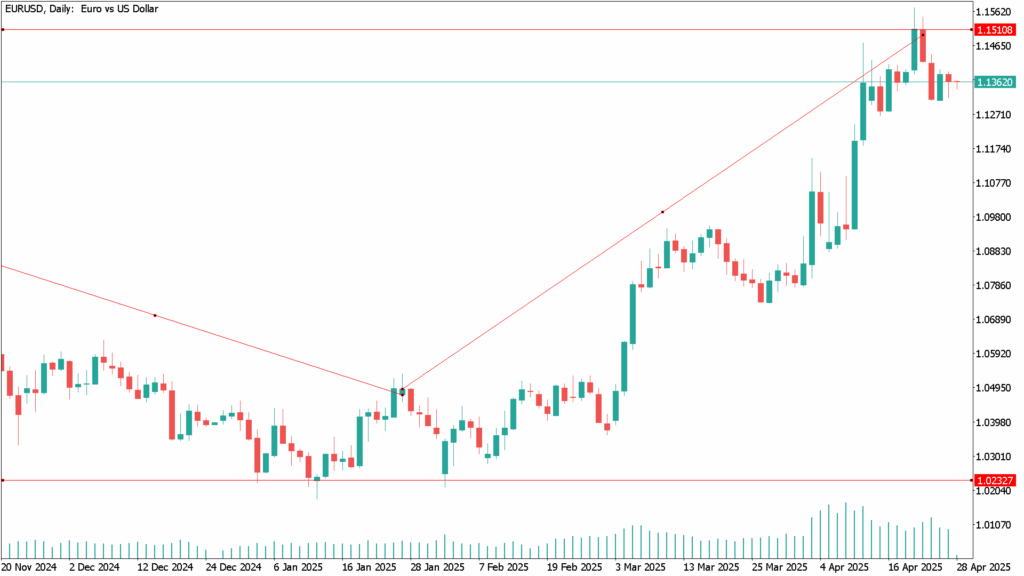

EUR/USD Daily Technical Analysis for April 28th

On the daily chart, technical indicators still suggest the broader EUR/USD uptrend could resume despite the current pullback. While buyers have temporarily stepped aside, there are no clear signs of a deeper decline, with technical indicators consolidating comfortably above their midlines. The 20-day Simple Moving Average (SMA) also continues to rise below the current price, offering dynamic support around 1.1180.

Immediate resistance lies near the 1.1400 area. A break above this level could open the path toward the 1.1470 zone, ahead of the yearly high at 1.1573. Should the pair clear that barrier, further gains toward the 1.1600 mark would become likely. On the downside, initial support is seen around 1.1300; a decisive break below this level could trigger a deeper correction toward the 1.1160–1.1170 region.

While U.S.-China trade headlines are likely to continue driving sentiment in the near term, the broader EUR/USD trend remains tilted to the upside. Traders should remain cautious, however, as conflicting signals from both Washington and Beijing may fuel volatility around key levels in the days ahead.