EUR/USD prices attempted to rebound last week, reaching the resistance level at 1.0753. However, the dollar recovered strongly after consumer spending data showed stronger-than-expected growth in the first quarter of the year.

Recently, EUR/USD dipped to 1.0674 support before ending the week around 1.0692.

On the other hand, the dollar remained in the spotlight ahead of this week’s Federal Reserve announcement and U.S. employment data, both likely to have a strong and direct impact on the currency market and its dollar-led performance.

According to economic data, the Core Personal Consumption Expenditure (PCE) price index was reported at 3.7% on an annualized quarterly basis, 0.3 percentage points above estimates. The core PCE price index, a key indicator of inflation within the U.S. GDP report, reflects price changes in goods and services consumed by individuals.

Clearly, the higher-than-expected reading suggests demand-driven inflation pressures, reinforcing expectations that the Federal Reserve will keep interest rates unchanged for an extended period.

In the past, the U.S. Gross Domestic Product (GDP) reading came in below market estimates, coming in at 1.6% on an annualized quarterly basis noticeably below the consensus estimate of 2.5% and last quarter’s 3.4% increase. This may to some extent stem the dollar’s advance as analysts report that inflationary pressures will continue to ease in response to the economic slowdown.

Fed Chairman Jerome Powell’s remarks this week will be closely watched by investors, who are looking for clues as to how long the Fed intends to wait before initiating rate cuts. In recent statements, the chairman has indicated that policymakers are likely to maintain current borrowing costs for a considerable time.

That said, market expectations right now believe that the Fed is very likely to make only two rate cuts in the second half of this year.

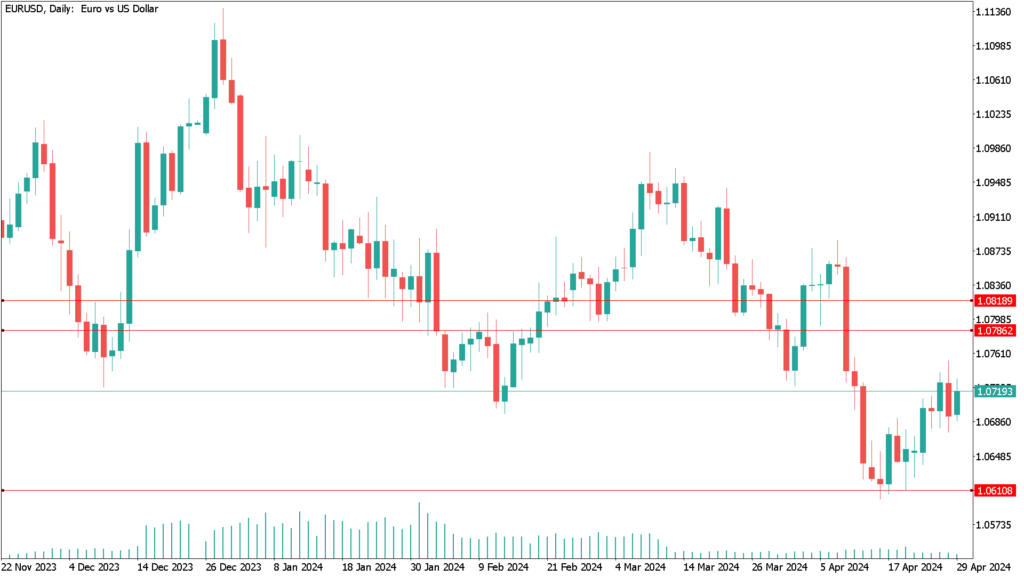

Daily technical Analysis EUR/USD April 29th

Although the pair has attempted to rebound, the broader trend confirms the euro’s continued downtrend against the dollar (EUR/USD).

From the technical aspects, should the EUR/USD pair return once again to the support zone near 1.0630 it could serve as a reinforcement of forecasts of a move towards the psychological support of 1.0500 in the short term. Additionally, this could accelerate should the Fed and its chairman’s statements serve as tightening support, adding to better-than-believed employment figures in the country. On the other hand, using the same time frame, upward movement towards the 1.0780 and 1.0830 resistance levels will be important if the current downtrend is to be broken.

Finally, the EUR/USD price is expected to move within a narrow range as investors and markets anticipate the impact of upcoming US Federal Reserve decisions and the latest US employment figures.