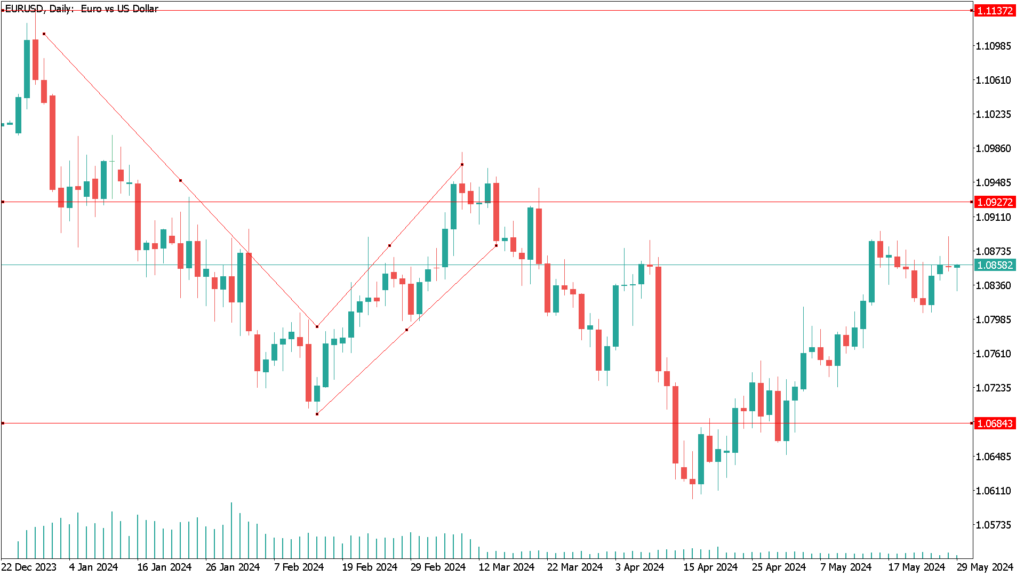

In an attempt to drive the EUR/USD price higher, the pair rallied yesterday, reaching the resistance level of 1.0889 before stabilizing around 1.0850. Recently, traders of the European currency (EUR) have been awaiting the German inflation figures.

At the same time, the US dollar (USD) continues to rise ahead of the Federal Reserve’s policy tightening. Initially, trading ranges may be tight; however, potential signs of weakness in the US economy, combined with recovery in the Eurozone, could increase the upside risks to the EUR/USD exchange rate. Right now, markets estimate less than a 20% chance of a rate cut in July. Analysts also believe that a July rate cut is still possible and indicate that the influx of data in the US is signaling economic weakness. Similarly, the market is awaiting the latest PCE price data, as well as the ISM business confidence and employment report, due at the beginning of June.

Additionally, two inflation-related data releases are scheduled before the July meeting.

Last week, the EUR/USD reached its highest level in eight weeks, peaking just below 1.09, before falling to 1.0835. It is notable that the EUR/USD has only traded above 1.10 twice this year.

As for the European Central Bank, the market expects interest rates to be cut in June, and some are expecting two more rate cuts before the end of the year.

EUR/USD daily technical analysis May 29:

The EUR/USD exchange rate is likely to remain range-bound until the US and European inflation figures are released. According to the daily chart, the 1.080 support level remains vital for the bears to continue to move lower. Otherwise, the bulls will not gain further control of the trend unless they breach the resistance levels at 1.0890 and 1.0955, which could generate momentum toward the psychological resistance at 1.1000. On balance, the strategy of selling the EUR/USD remains the most solid.