The EUR/USD pair extended its upward momentum on Wednesday, climbing toward the 1.1390 mark during the European session. The move comes amid sustained weakness in the U.S. dollar, pressured by softer-than-expected U.S. economic indicators. Traders are now turning their attention to high-impact economic data releases from both the U.S. and the Eurozone, including Germany’s retail sales and inflation data, as well as the March U.S. PCE report.

Dollar Slips on Soft Labor and Confidence Data

The greenback came under renewed pressure following disappointing U.S. labor market and consumer sentiment figures. According to the U.S. Bureau of Labor Statistics, job openings in March dropped to 7.19 million—marking the lowest level since September 2024 and falling short of the expected 7.5 million. This decline signals easing labor demand amid mounting economic uncertainty.

Additionally, the Conference Board’s Consumer Confidence Index tumbled to 86.0 in April from a revised 93.9 in March—its lowest level since April 2020—further reflecting waning optimism among U.S. consumers. These figures have intensified expectations for a Federal Reserve rate cut, with market pricing now reflecting a 56.8% probability of easing, according to Fed funds futures. This shift in sentiment has contributed to broad-based dollar weakness and supported further gains in EUR/USD.

Focus Shifts to Eurozone Economic Releases

Market participants are closely watching key upcoming data from Europe. Germany is set to publish retail sales, CPI figures, and a preliminary estimate of Q1 GDP, while the broader Eurozone will release its own Q1 GDP growth estimate. A stronger-than-expected reading from any of these reports could lend further support to the euro and extend the pair’s bullish momentum.

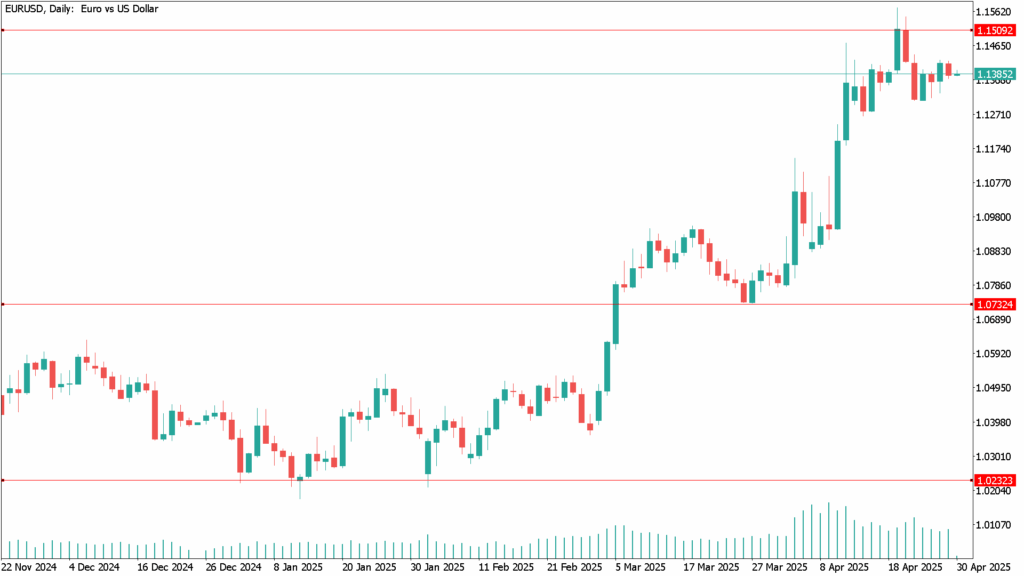

EUR/USD Daily Technical Analysis for April 30th

The EUR/USD pair remains in an upward trajectory ahead of critical U.S. economic releases. Bulls are currently targeting the 1.1425 resistance level, with the broader outlook suggesting a potential retest of the psychological 1.1500 level if the current trend continues.

While dollar stability had been observed prior to this rebound, sentiment remains fragile. Analysts suggest that a surprisingly strong U.S. economic report—particularly concerning employment—could temporarily halt the pair’s ascent. On the downside, key support is seen around 1.1250. A breach below this level would open the door to further losses toward 1.1145 and possibly 1.1000, which would mark a shift to a bearish trend.

On the long-term horizon, Goldman Sachs maintains a 12-month target of 1.20 for EUR/USD, citing improving eurozone fundamentals and softening U.S. growth expectations.

A break above the 1.1425 resistance would likely clear the path toward 1.1500. Technical indicators such as the 14-day Relative Strength Index (RSI) and MACD would then approach overbought levels, potentially triggering momentum-driven buying. The outlook would be further supported by disappointing U.S. jobs and inflation data, alongside dovish Fed commentary and positive trade developments.

A decline below the 1.1260 support level could shift market sentiment in favor of the bears. Sustained trading beneath this threshold would likely drive the pair toward deeper support levels at 1.1145 and 1.1000. In this case, the RSI would retreat toward the neutral 50 mark, reinforcing a shift in the technical bias to the downside.